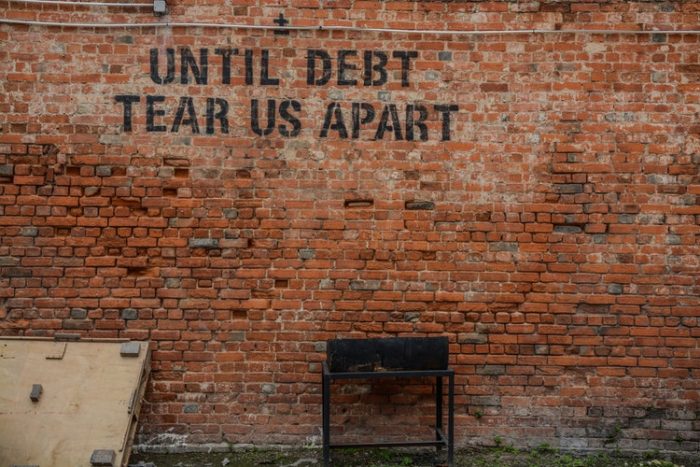

Getting out of debt is one thing, but how can you stay out when you get out? As someone who is naturally spontaneous, trying not to spend money can sometimes be hard!

I know I’m a very spontaneous person, which has both its ups and its downs.

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

The kids love it as we do fun stuff at the drop of a hat. If I fancy doing something, then we’ll do it. I like living life in the fast lane.

On the flip side, being spontaneous has not done well for my bank balance.

Cost was an afterthought

When I want to do something money used to come as a second thought. The buzz of having something new, or having an amazing experience came up on my radar first, and the actual cost wasn’t considered.

This is what really landed me in debt in the first place.

I knew the credit cards needed to be paid but just made the minimum repayments, taking the spare cash and heading out on another adventure.

Only making small payments came at a cost, and the debts got bigger and bigger.

Trouble is, when something bad then happened, saving money was not in my vocab, and there was nothing spare left on credit.

I remember in the space of a month that the engine fell out of the car, the washing machine packed in and so did the fridge freezer! Well, they do say it happens in threes.

Our only option was to get another credit card to fix the car and appliances. We had to get a repair as I had to have a car for work. Public transport wasn’t an option as I worked split shifts, miles away.

It got too much

Getting a credit card worked, but it created a bigger problem the month after.

We could manage our current minimum repayments, but when the new bills hit our doormat, foolishly I hadn’t really factored in having to pay it back ☹

With the new repayments, it took us over the edge and there was nothing spare. To make it through until payday and, as another quick fix, I got a payday loan.

It gave us back the breathing space we needed, at a cost!

This turned into a vicious cycle of not being able to afford anything. The interest on the payday loans ate into our budget more and more and we were taking near on £1,000 in high-interest loans each and every month – for months!

Things had to change

I suppose if all that stuff didn’t break down at the same time then maybe our debt situation wouldn’t have spiralled as it did?

But, would something else have happened instead?

I still wouldn’t have been saving money and I still would have been spending willy-nilly.

It’s funny as although, today, I think I’m a much different person, having learnt from my money mistakes, I’ve taken the HSBC UK Bank-Life Balance test which shows I’m still a Spontaneous Spender!

Even after cutting back our spending and changing how we manage our finances I am a natural spender, through and through.

It’s obviously just in my genes.

While our hard work has paid off to clear our debt, I worry that I might fall back into the trap of overspending.

I try to be so overly cautious now, so this won’t happen and here’s how we’ve kept ourselves out of the red after getting debt free.

Just say no

Sounds far easier than it is! Saying no seems to be a very un-British thing to do. We, as a nation, like to please, so saying no to things isn’t always easy, especially as I have the traits of a spender.

Saying no to spending money is what I should have been doing years ago, but the habit wasn’t there.

When it comes to spending money, I’ve now got very used to saying no to myself before getting too attached to the idea of buying something.

No, we don’t really need it.

No, it is not in my budget.

No, we won’t buy it.

Give yourself some breathing space

If I still can’t bring myself to say no, then I just try to put off spending money.

Trying to sleep on the decision is a good way to work out if I should splash the cash.

Either I’ll wake in the morning and forget I even wanted to buy something, or I’ll still have that urge.

The best thing about having a bit of breathing space is it can give more time to find a bargain.

Instead of buying on impulse, I can also have more time to hunt out a bargain.

Check your finances regularly

When we were working our way out of debt, I promised myself I never wanted to get back into the situation again, and I would never use credit again.

Looking back, I think it was a rash decision and, to help build my credit rating, I am now the proud owner of a credit card.

Even though I’ll only make a few purchases each month, nothing too big, I regularly check my online account and the monthly statement.

I want to make sure that there are no accidental purchases, and that I will be able to afford to clear the credit card and pay it off in FULL every month.

I also regularly check my bank account, tracking spending and direct debits so I can be clear where money is going.

A tool like the Connected Money app for HSBC UK online banking customers can help with managing your money, as rather than having to log into each of your accounts individually, you can see them all clearly in one place.

It’ll make keeping your eye on your finances a doddle!

Seek advice…with a pinch of salt

Your parents, your partner, your kids, and work colleagues all have opinions. Some should be listened to and others should be taken with caution.

Getting advice from people is great, but as they all come from their own backgrounds and have their own financial personality.

Because of that, they may not give you the best advice for your own circumstances.

While their thoughts are trying to help you decide if you should spend out on something new, it may be worth getting more than one opinion.

Be a time traveller

Put yourself in your shoes in a weeks’ time.

Now do it again in 6 months’ time and 12 months’ time.

How do you feel about your purchase when you see yourself in the future?

Maybe that nice shirt you see today would be in the back of the wardrobe, or you would be selling it on eBay? In that case, should you really spend your money today?

On the other hand, your spend may be really needed in the future. If you need to replace the boiler or get a new car then your purchase will be really useful in a years’ time.

You need to weigh up the impact of your purchase and if it’ll still be needed in the future, as well as today.

Build an emergency pot

Saving money might sound like a boring thing to do, but it’s so worthwhile.

When you get into it, it gets quite fun seeing your money slowly add up.

With an emergency fund, you’ll know that you have a cushion to fall back on, which means you won’t need to turn to more expensive means of credit and debt.

Building a buffer doesn’t always need to be about cash.

Why not try to buy a few birthday presents through the year or pop an extra tin of beans or bag of pasta into your shop. Creating a mini stockpile at home can help when there’s a kid’s party you weren’t expecting (and didn’t budget for) or when things are tight, and you need to stretch your food bill.

My financial personality of living as a Spontaneous Spender has meant I’ve had great times, but it’s also meant I’ve had a lot of bad financial habits I’ve needed to break.

Recognising this has really helped me break the cycle of bad money habits and change things up financially.

Written in collaboration with HSBC UK

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- Side hustles and benefits in the UK: what you need to know - 8 January 2026

- Lloyds Bank switch deal: grab £250 plus Disney Plus for free - 6 January 2026

- Thinking of doing the Co-op freezer deal? Read this first - 6 January 2026