Stay in control of your money and solve common problems with finances using these money apps.

Sponsored by Open Up 2020 Challenge

We’ve all become very used to dealing with the ups and downs of all life can throw at you.

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

Millions of people had a pay cut and have been paid via furlough, others needed to look into getting support with money via Universal Credit, and others have had more money as they’ve not been able to spend it.

We’ve been struggling financially. We may have a budget worked out and plan for where our money goes, but nothing could prepare us for what 2020 had to offer. Even with a decent cupboard full of food and a bit of an emergency fund, our finances have been thrown up in the air.

Essentially, I felt like we were starting again! We needed to go back to our budget, give it an overhaul and start again with new eyes.

But even forgetting about any pandemic, according to research last summer from the Open Up 2020 Challenge, 29% of people regularly run out of money each month. That’s not a fun place to be!

I want to be sure we can keep an eye on our money, so we can be better in control, and can manage our finances.

And these apps will help manage whatever financial situation you’re going through.

Download and try out these apps so you can see how much control you can have with your finances, and you can be more prepared for the future.

Money apps to help control your finances

These are just a few of the money apps you could be using to better budget, manage debt, and automate savings.

Tully – for people who need debt advice

Millions of people have been affected financially in the short term by what’s been going on in 2020, and Tully is there to help.

If you’re in debt or are struggling with finances in these uncertain times, this digital debt adviser gives you online budgeting, debt advice, payment relief – all for free – to alleviate financial stress.

I get that speaking to someone in person or on the phone can be really nerve racking when it comes to discussing the nitty-gritty and mistakes you’ve potentially made with debt. It took a long time for us to admit to others that we were in debt and part of that was not wanting people to know how badly we’d messed up. Using this app to start the process of getting rid of your debt may take away the anxiousness you might feel talking about money.

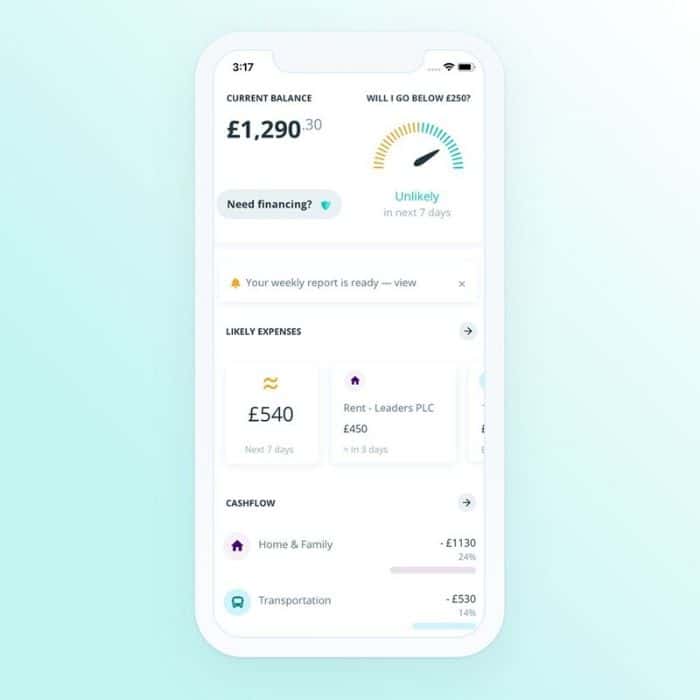

Pave – for people who have an irregular income

Not everyone gets paid on the same day each month, so for anyone who has different earning patterns, with money dropping into your bank all over the place, this app is for you.

Pave (formally Portify) learns your income patterns (even if they are variable), and looks at your spending behaviour, then helps to prevent you from getting overdraft or interest payments through a fee-free credit line. You can even improve your credit score.

Wagestream – for people who have too much month at the end of the money

Don’t turn to expensive short-term loans! Look at Wagestream instead. The app allows you to access, at any point in the month, your earned wages, track your income in real-time, start to save, and access impartial financial education.

To help with the challenging times, the app has evolved to meet the needs of customers by allowing immediate overtime payments for under-pressure healthcare workers. Anyone who logs an overtime shift as COVID-19 can access 80% of the wages earned immediately.

Kalgera – for people who want to prevent fraud

While we think we’re savvy when it comes to fraud, it’s always a worry that an older or more vulnerable person in your family may get hit by a scam.

Your solution is Kalgera – the service is there for older or vulnerable people with cognitive impairments and uses neuroscience and AI to detect and predict financial vulnerability. It will send an alert to a trusted friend or family member to help prevent fraud. Here’s hoping you’ll never need it, but so useful just in case.

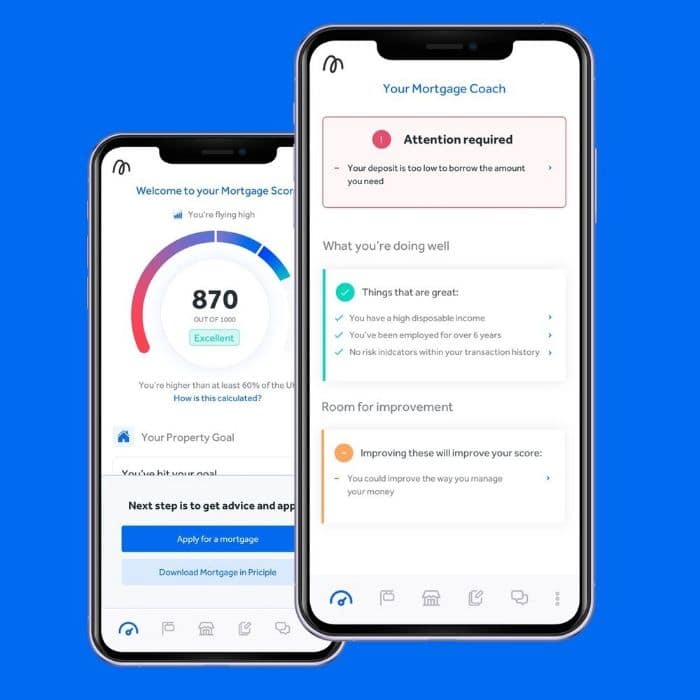

Mojo Mortgages – MortgageScore™ – for people who want a mortgage

Want to apply for a mortgage but worried you’ll get turned down?

With MortgageScore™, they can combine your credit and spending habit data to see if you’re mortgage ready – and if not, the app gives personalised advice on how you can be.

While these apps can really make a difference to how you manage your money, be sure to take a look at all 15 finalists of the Open Up 2020 Challenge.

This is a national challenge that highlights some of the best financial services apps and services out there. The aim is to help give people more choice and access to financial services – especially those excluded from existing services – through the use of open banking.

The apps and services have been chosen by an independent panel of judges from hundreds of entries – and the finalists have some of the best ways to use open banking and revolutionise money management.

What’s open banking?

Being in control of your money is far easier using these apps, but it wouldn’t be possible without open banking. These apps all use open banking to better support you in managing your money – in ways you may have never thought existed.

I used to be one of those millions who had less than £100 in savings. Using apps with open banking, it has enabled me to automatically save money when I used to struggle to save each month. Knowing I’ve got a bit of an emergency fund to fall back on relieves money tension – and it happened with pretty much no effort!

And open banking has allowed me to cut down on spending and save on my budget as these apps can see if I’m spending more than I need to.

You may not have heard of open banking before, it’s been going for a few years, and is governed by the CMA (Competition and Markets Authority) and backed by the UK’s nine biggest banks and building societies, meaning you don’t need to worry about safety.

And, in such a short space of time, it’s been able to change our relationship with money and allow us to have better control in a safe and secure way.

How open banking works

You may not even realise you’ve been using open banking as it feels like a smooth process that goes on in the background. You simply authorise regulated third parties (such as the apps in this article) to access your data safely and then get access to new and different ways to look at your money.

It really is that simple, and instead of working away with calculators and bits of paper (don’t get me wrong, I love a good list), the apps are more innovative. By allowing regulated companies to securely analyse your bank data, the apps can show you personalised ideas and give ways to manage your money safely.

Like with Canopy for renters (not mentioned above, but another of the 15 finalists), you approve the app to sync with your bank account and then they can tell you how you could improve your credit score without you needing to put in as much effort.

Straight away, you’re able to find issues and can then fix it. Yeah, it’s one of those jobs you should keep on top of, but with everything else going on in life, life admin can get pushed aside.

So these apps can help you access financial services easily and allow you to take control.

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- I was sent a fake HMRC tax notice. Here’s how to spot the scam - 8 January 2026

- A once-a-year money check most families forget (with rough savings) - 6 January 2026

- The January bills reality check: the traffic light method that works - 1 January 2026

Mr. Barry Buttery says

I found this article to be very useful. The article on parking was excellent

Keep up with the good work