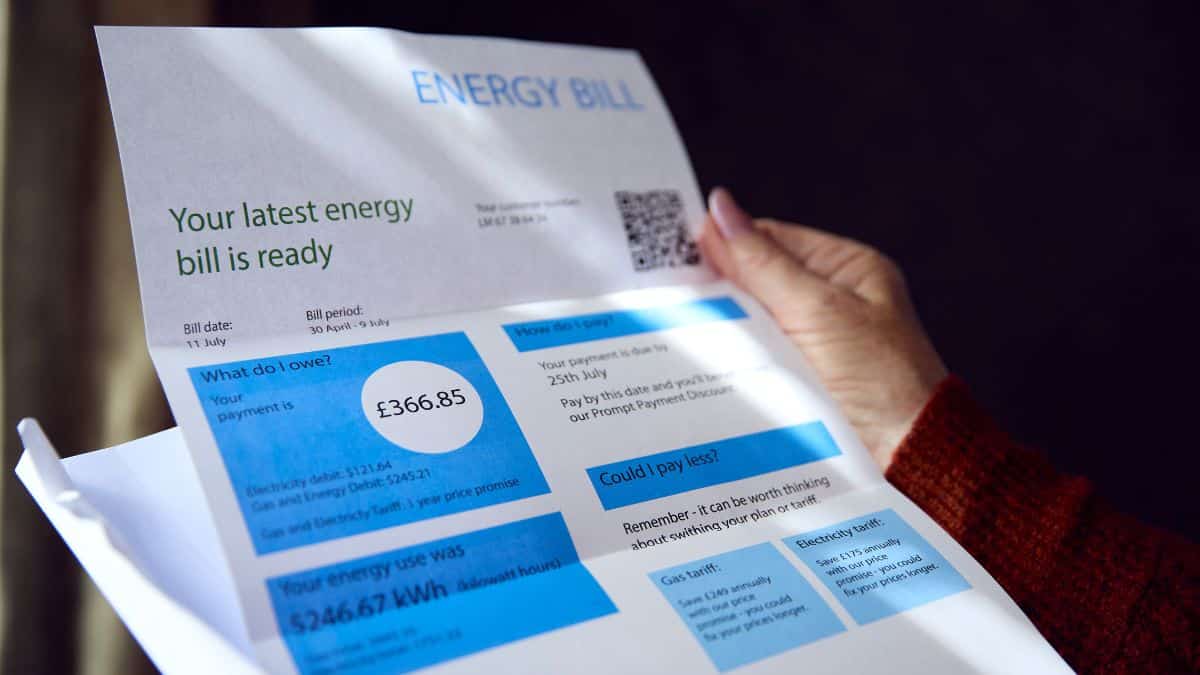

You could be owed money without knowing

Across the UK, people are finding out they’ve been sitting on energy credit for months, even years. Some only notice by accident when they switch supplier or finally log into their account.

With bills still painfully high and every penny counting, the idea of cash being left untouched in an energy account feels a bit ridiculous. But it happens all the time, and suppliers rarely rush to point it out.

This guide walks you through why this credit builds up, how to check if you’re owed anything, and the quickest way to get your money back.

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

Why this matters now

Energy costs are still eating into household budgets, and many people are looking for any small win that can make the month feel easier.

If you’re trying to bring your usage down as well, our guide on how to cut your gas and electric costs can help you lower what you spend while you check if you’re owed anything.

Having unused credit sitting on your account at a time like this isn’t just frustrating. It’s money that could be helping you today, not months down the line.

Why energy credit builds up

A credit balance simply means you’ve paid more in than you’ve used. It’s your money, not a bonus for the supplier.

This happens for everyday reasons. Direct debits stay the same even when your usage drops in summer. Old estimates stick on accounts if meter readings aren’t up to date.

Some suppliers take payments early in the billing cycle, so the credit builds before the bill even gets worked out.

Prepayment households aren’t completely protected either. Your top-ups sit in credit until they’re used.

And if you recently joined a new supplier, they might have taken an upfront payment that shows as credit straight away.

What happens if the account is closed?

The credit stays yours. It doesn’t vanish because you moved house or switched companies.

Suppliers must follow clear rules. After you switch, they should send your final bill within 6 weeks, and refund any credit within 10 working days.

If they miss these deadlines, they’re supposed to pay compensation on top.

This also applies if you’re sorting the account of someone who has passed away. If there is money left, it should go back to the estate.

How to claim your refund

It’s usually simple. If your account is still live, ask your supplier for the refund. They may want an up-to-date meter reading so they can check everything is accurate.

If your account is closed, contact your old supplier with whatever details you have. Even an address is often enough. There’s no time limit on claiming.

If the supplier refuses, delays unnecessarily, or keeps giving excuses, make a complaint. You’re well within your rights.

Skint Dad says:

Getting your own money back shouldn’t feel like you’re asking for a favour. If they owe you, they owe you.

How much people are getting back

It varies a lot. Some households receive a small amount. Others get hefty refunds, especially when old estimates were miles off.

Regulators have said for years that millions of households build up unused credit without realising.

Many only notice when they switch supplier or check online for the first time in ages. It’s far more common than people think.

Should you leave the credit where it is?

It depends on your situation. A small credit going into winter can soften bigger bills later on, especially when the average energy bill in the UK is still high for many households.

Some people prefer keeping that buffer because it helps avoid sudden jumps in their direct debit.

But if money is tight right now and the credit would genuinely help you, there’s nothing wrong with asking for it back.

It’s your cash, and your supplier has to justify any changes they make to your payments.

What to do if things go wrong

Suppliers must refund credit within ten working days of sending your final bill. If they don’t, they owe you £40 compensation.

If they then miss the deadline to pay the compensation itself, they may owe another £40.

If you feel stuck, Citizens Advice (or Advice Direct Scotland) can support you. Their Extra Help Unit can even take the case on directly if you’re in a vulnerable position.

How to stop credit building up again

Send regular meter readings unless your smart meter is working perfectly. This stops overestimations and keeps your bills accurate.

Log in every few months to check your balance. It takes seconds and could save you from months of paying too much.

If your direct debit feels too high, ask your supplier to explain how they set it. They must give you a fair reason. If it looks wrong, they should lower it.

Final word

Energy suppliers owe millions in refunds every year. A quick look at your account could show that some of it belongs to you.

With bills still tough for many families, it’s worth checking. Whether it’s a small amount or something chunkier, that money is yours and could make a real difference.

If you’re unsure, check your online account, send a meter reading, then ask the question. You’ve got nothing to lose and possibly money to gain.

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- Side hustles and benefits in the UK: what you need to know - 8 January 2026

- Lloyds Bank switch deal: grab £250 plus Disney Plus for free - 6 January 2026

- Thinking of doing the Co-op freezer deal? Read this first - 6 January 2026