Many factors go into your score, including your payment history and how much debt you have. But what is an average credit score?

Your credit score is influenced by several factors, including your payment history and how much debt you have.

Let’s take a look into what an “average” score is so you can see if you need to make any adjustments to how you manage your finances.

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

If you’re looking to improve your credit score, you can do a few things, such as paying your bills on time, checking your credit report, and using a credit monitoring service.

Let’s look at these improvements in more detail so you can receive a more positive credit report, get offered more generous credit limits, and get lent money more cheaply and easily.

How are credit scores calculated?

Generally speaking, the scores are calculated using several different factors. These include whether you have a good credit history or poor credit history, your payment history, such as missed payments, and the type of credit you have.

If you have always made your repayments on time and borrowed smaller amounts compared to your total credit limit, then there is a good chance that you will have a higher credit score, and this will be reflected in your credit report.

Your credit score is a number that represents your creditworthiness or how likely you are to repay a loan. A higher score means you’re more likely to get approved for a loan or credit card with a lower interest rate. A bad credit record could mean you may not be approved for a loan at all.

Lenders typically use different methods to calculate your average score, but the most common scoring models used are FICO and VantageScore. The average is worked out by taking the total of all the credit scores and dividing it by the number of people in the sample.

FICO is the most widely used credit scoring model and is implemented by the Fair Isaac Corporation (FICO). Your FICO score ranges from 300 to 850 and is based on your payment history, credit utilisation, length of credit history, and other factors.

Created by the three major credit bureaus – Experian, Equifax, and TransUnion – VantageScore also offers average credit scores from 300 to 850. However, it uses a different methodology than FICO and weights certain factors differently.

For example, VantageScore puts more emphasis on recent credit history than FICO does.

Average credit scores in the UK

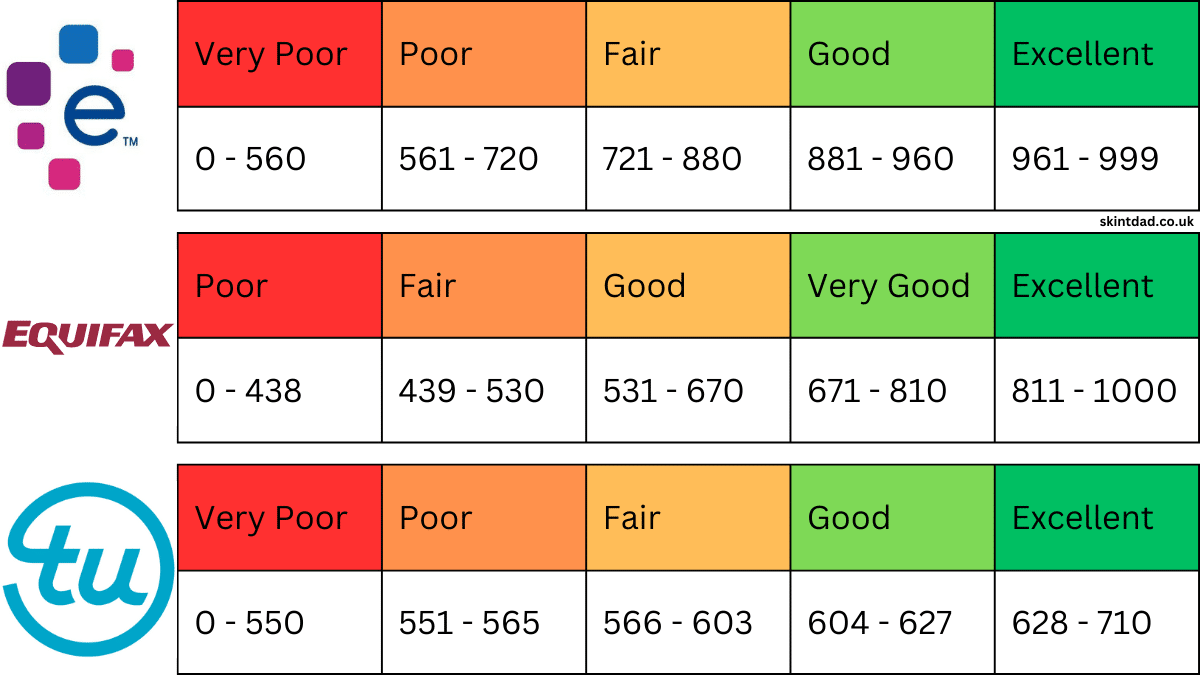

Here is an overview of the bands and ranges for the credit referencing agencies.

The average scores for each one are shown below.

Experian average score

Experian scores can range from 0 – 999.

The average UK credit score for Experian is 714.

Experian credit score range and bands

The table below shows the Experian score bands and their ranges.

The bands get smaller the closer you get to “excellent”.

A good Experian credit score is from 881 to 960 points.

| Rating | Experian score band |

|---|---|

| Very Poor | 0 – 560 |

| Poor | 561 – 720 |

| Fair | 721 – 880 |

| Good | 881 – 960 |

| Excellent | 961 – 999 |

Experian is one of the main three credit rating agencies in the UK, along with Equifax and Callcredit. A good Experian score means that you’re likely to be accepted for most types of credit, including loans, mortgages, and credit cards.

It also means that you’re likely to get better deals on these products, as lenders see you as a low-risk customer.

If you have a bad Experian credit score, it may be difficult to get credit at all. Anyone can do a credit check, and even employers sometimes run a credit check before they hire someone.

Experian is a global information services company with operations in 40 countries, and the company gathers and maintains consumer credit information on more than 220 million people worldwide, meaning it’s a good place to start for your credit file.

Equifax average credit score

Equifax’s credit scores range from 0 – 1,000 (it used to be a maximum of 700).

According to their website, the average credit score in the UK is 383.

Equifax credit score range and bands

The table below shows the Equifax’s score bands and their ranges.

A good Equifax credit score is from 531 to 670 points.

| Rating | Equifax score band |

|---|---|

| Poor | 0 – 438 |

| Fair | 439 – 530 |

| Good | 531 – 670 |

| Very Good | 671 – 810 |

| Excellent | 811 – 1000 |

As one of the main credit rating agencies in the UK, Equifax plays a big role in determining average credit scores.

This is based on data from December 2018. Equifax uses a number of different factors to calculate a credit score. This includes looking at an individual’s financial history and current financial situation.

They also take into account things like whether someone has been registered on the electoral roll and if they have any County Court Judgments or bankruptcies against their name.

It’s important to remember that each agency has its own way of calculating credit scores, so an individual’s score may be different depending on which agency is being used.

However, Equifax is a major player in the industry, and its scores are generally considered to be accurate.

TransUnion average credit score

The TransUnion credit scores range from 0 – 710.

A good credit score with TransUnion is anywhere from 604 – 627.

TransUnion credit score range and bands

The table below shows the TransUnion score bands and their ranges.

A good TransUnion credit score is from 604 – 627 points.

| Rating | TransUnion score band |

|---|---|

| Very Poor | 0 – 550 |

| Poor | 551 – 565 |

| Fair | 566 – 603 |

| Good | 604 – 627 |

| Excellent | 628 – 710 |

TransUnion is a credit reporting agency that compiles information on individuals’ borrowing and repayment history.

This information is used by lenders to determine an individual’s creditworthiness.

In the UK, TransUnion maintains records on approximately 27 million people.

How are average credit scores calculated?

According to data from Experian, probably the most popular credit reference agency, the average credit score in the UK is 714.

This score is based on a sample of 2,000 people who have a wide range of credit scores. So, what does this mean for you?

What do they mean?

If you have a good credit score, it means you will probably be approved for loans and credit cards.

If you have a bad credit record, you’ll likely be refused credit for loans, and borrowing money from banks or money lending businesses will become very difficult.

Find out:

How to get a better credit score

If you’re looking to improve your credit score, there are 3 things you can do:

First, make sure you’re on the electoral roll. This will help lenders verify your identity and make it more likely that they’ll approve your applications.

Second, use a mix of different types of credit, such as a loan or credit card, mobile phone contract, and store cards. This shows lenders that you can manage different types of debt responsibly. People can build up their scores over time, with credit reference agencies, and get good interest rates

Finally, try to keep your balances low relative to your credit limits. This shows that you’re not using too much of your available credit, which is a sign of financial health. Pay your bills on time (car finance, electric, and gas).

Does everyone have a credit score?

No, not everyone has a credit score.

In the UK, credit scoring is voluntary, so there are some people who choose not to have a score. However, most people in the UK do have a credit score, and it’s generally seen as a good thing to have one.

Do I just have one credit score?

No, you have multiple credit scores.

Credit scoring is a complex process, and different lenders use different scoring models. So, while one lender may base their decision on your Experian credit score, another may focus on your Equifax credit score.

It’s important to remember that there is no “one” credit score.

Lenders look at many factors when considering a loan application, and each lender has its own criteria for what constitutes a good or bad score.

How are credit scores ranked/given a credit rating?

Credit scores in the United Kingdom are ranked on a scale of from zero up to 1,000, depending on the company that does the ranking.

The higher your score, the better your creditworthiness and the more likely you are to be approved for loans and credit products.

There are a number of factors that go into calculating your credit score, including your payment history, credit utilisation, length of credit history, and more.

You can see what your credit score is for free on various websites, including Experian and Equifax.

Don’t open new lines of credit unnecessarily, as this can hurt your score.

Remember, an excellent credit score takes time, and if you see any mistakes in your credit file, be sure to fix them. You’ll help boost your own and the average credit score of the country!

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- I was sent a fake HMRC tax notice. Here’s how to spot the scam - 8 January 2026

- A once-a-year money check most families forget (with rough savings) - 6 January 2026

- The January bills reality check: the traffic light method that works - 1 January 2026