When you get in debt trouble (or even if you feel like it’s getting too much), our first response is always to reach out for debt help.

You’re able to get free debt advice from a load of organisations.

They will tell you the best course of action for you, based on your own circumstance (like how much you earn, how much your debt is, how much your other bills are etc).

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

Debt Management Plan

Sometimes this will be a Debt Management Plan (DMP) where your debts are combined into one single payment. The debt advice organisation will talk to your creditors on your behalf to sort out the payments.

However, there are some other companies who will charge you for this.

In my opinion, why should you pay if you can get exactly the same service for free somewhere else?

But, sometimes people do reach out to companies to pay for this.

Maybe they don’t know there are other free options, or they see an advert on TV or online and just go for it (as they might not do it otherwise). While they are paying for a DMP, it’s at least starting to get the debt paid off.

When you have a DMP, each month you will make your debt repayment, but you first pay a fee to the provider. What’s left will go towards your debt. This may mean you end up paying back a DMP longer if don’t opt for the free route.

All is fine, either way, until the company who set up your DMP gets closed down.

Immediate Financial closed down

A member of the Skint Dad Community Group reached out to us for some support after finding out that her DMP provider, Immediate Financial had closed down.

She wants to remain anonymous, so we will refer to her as “Mrs A”, but she wanted to share her experiences of what happened, with the hope it will help others who are in the same boat or are in a similar situation in the future.

Mrs A went down the route of paying for debt advice as it took the stress out of the situation and, without them, she would not have started to clear her debt at all.

The first she found out about Immediate Financial closing down was a phone call. She told us:

“I had a voicemail and thought it strange when I called up because their message had changed from pressing numbers to stating their offices would still be open in June.

“On the phone, I was told they were no longer trading and that my money would be returned and an email sent with a final statement.”

This is what she got!

Getting money back

Mrs A hadn’t received any letter or emails from them until she asked that they send her a statement through to see what she’d been paying and what debt was left.

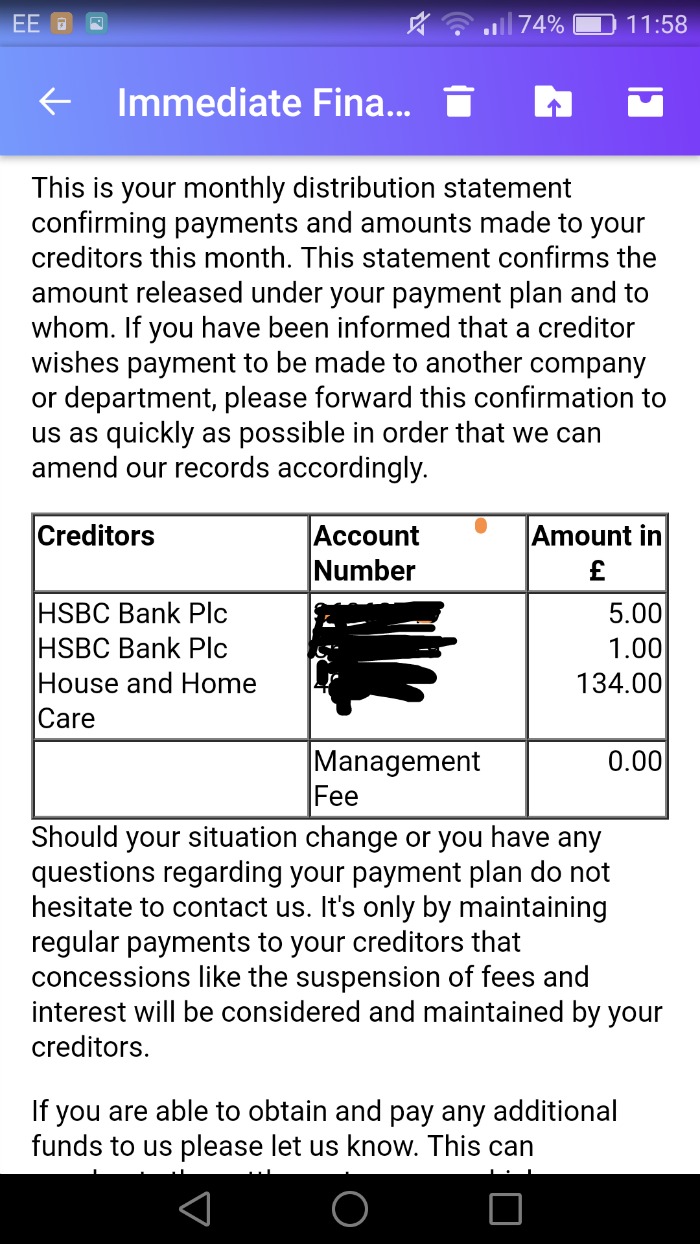

Her monthly statement showed that she had one creditor left to pay and she was paying £140 a month.

From her payments, £5 was going to one debt with HSBC Bank and the other £1 was going to another debt with HSBC Bank.

She was paying House and Home Care Ltd (who are the company who own Immediate Financial) the bulk of the payment.

She told us that Immediate Financial had advised her that they save the money she pays aside each month.

They make the minimum payments to her creditors and, when they’ve saved enough, will make a final settlement deal with the creditors.

As Immediate Financial are closing down, they agreed to return the money she paid to them (and wasn’t passed onto creditors) which totalled a few thousand pounds!

She is still awaiting a proper final statement from them.

Mrs A went on to tell us:

“I had a massive lump sum go into my account this morning and others may have the same happening soon without a clue what to do next.

“It’s easy when you’re in debt to feel like you’ve done something wrong, so you just take what you’re given without questioning.

“I was given the Money Advice number and have my husband now to help me keep my head out of the sand, but others may be feeling the worries and pressure of dealing with debt returning.”

What should you do?

We reached out to Sara Williams, debt campaigner and blogger at Debt Camel, to find out what people’s options are and what they should do next.

“Immediate Financial were an unusual sort of debt management firm. Instead of dividing your payments between your creditors each month, they saved them up (after taking their own high fees) to try to make lower offers to the creditors.

“This approach is called the “Debt Settlement Model” to distinguish it from “normal” DMPs.

“Sometimes it would work, but often it caused problems as the creditors realised they should be getting more each month and refused to freeze interest. And sometimes it went badly wrong if the firm didn’t put your money away safely, but spent it on nice cars for the directors then went bust…

Luckily that hasn’t happened here!

“Immediate Financial’s clients have had the money they have saved up returned to them. So what should this anonymous person do with the money?

“If she has rent or mortgage arrears, owes council tax or other urgent bills, probably the best thing is to pay them off, then set up a normal DMP for the two remaining debts that were with Immediate Financial.

“But if she doesn’t have priority debts she could consider using the returned money make settlement offers to her two debts. Anyone can do this, it doesn’t have to be a solicitor.

“I have looked at how to make these settlement offers in detail in my Guide to Full and Final (F&F) Settlements. That covers what to put in your offer letter, how it affects your credit record, and what else you might do if the debts are very old.

“To do this she first needs to know a bit more about the two remaining debts. I’m a bit surprised they are still with HSBC, normally a bank would have sold the debts by now. So I suggest she checks her credit record for example by looking at her Noddle report.

“Then when she knows who owns the debts and how much is owed, she can divide up the money between them to make offers. So if she has £3,000 and one debt is £2,000 and the other is £6,000, she could offer £750 to the smaller debt and £2,250 to the larger one.

“If the creditors say No, then she can just set up a normal DMP.”

Don’t panic!

Ultimately, if you find out that the company that set up your DMP is going under for any reason the best thing to do is not panic.

I get that it will be really overwhelming to have to sort it all out over again, but you will have plenty of time.

When you speak to your creditors and explain the situation, they will give you some breathing space to set up a new DMP or an arrangement directly with them.

They are not going to rush to the courts or start any action against you and would much prefer for you to talk to them to start fixing the new issue.

Things will get sorted but having a DMP provider shut down is just another hiccup in your journey to be debt free.

Read next: 8 Pieces of Advice You Should NOT Give to People in Debt

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- I was sent a fake HMRC tax notice. Here’s how to spot the scam - 8 January 2026

- A once-a-year money check most families forget (with rough savings) - 6 January 2026

- The January bills reality check: the traffic light method that works - 1 January 2026