As the self assessment deadline gets closer, HMRC scams start doing the rounds again. Emails, texts and even letters that look official land on doormats and inboxes, often designed to scare people into paying quickly.

I was sent one myself recently.

It used HMRC branding, talked about penalties and even mentioned prison.

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

But it was fake.

If you are self employed, rent out property, or have ever filled in a tax return, this is the time to be extra careful.

Why HMRC scams spike at this time of year

January is prime time for scammers. Millions of people are dealing with self assessment, checking figures, and worrying about deadlines.

Scammers know that stress makes people more likely to panic and act fast.

Most of these scams try to do one thing. Push you into paying money or handing over personal details before you have time to think.

They rely on fear, urgency and official looking language.

What the scam letter looked like

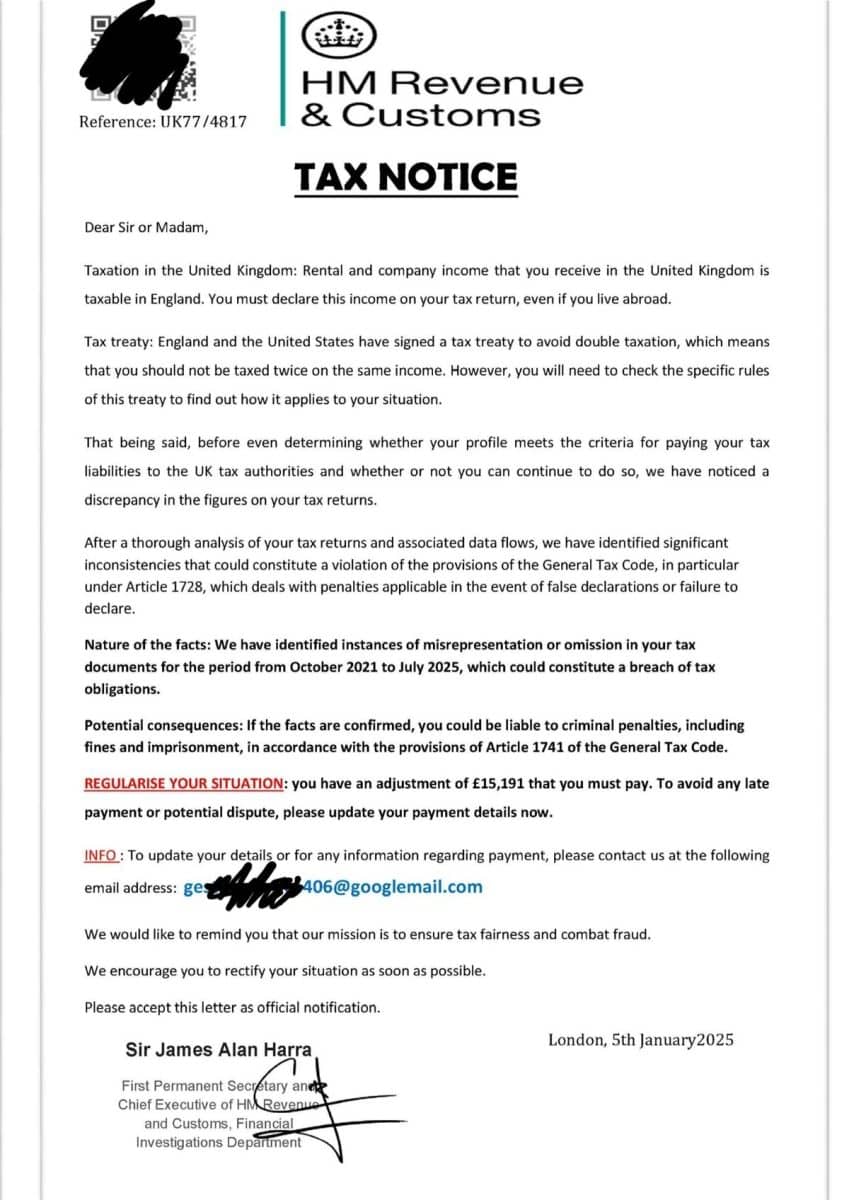

The letter I received used HMRC’s name and logo, included a reference number, and was headed “Tax Notice”.

It claimed there were discrepancies going back several years and warned of criminal penalties, including imprisonment. It then demanded a payment of over £15,000 and asked me to “regularise” my situation quickly.

That alone is a big red flag.

How many red flags you can spot

This is a photo of the letter I was sent. I’ve redacted a few parts, including personal details and the QR code, but the rest is exactly as it arrived.

Before reading on, take a moment to look at it properly.

See how many things you can spot that don’t feel right. We’ve found 25 different warning signs and red flags. Can you find more than us?

If you only notice one or two, that’s completely normal. Most people do. These letters are meant to overwhelm you and push you towards a quick decision.

Further down, we’ve written out a full list of everything we can see that shows this letter is fake. It’s there to help if you’re unsure what to look for, and to show just how many warning signs can be hiding in plain sight.

How HMRC really contacts you

HMRC does contact people by letter, email and text, but there are important differences.

HMRC will never ask for your full password or PIN by email or text. They will not ask you to click links to make payments without directing you to GOV.UK first.

They do not demand payment by email, and they do not ask you to reply with bank details.

If HMRC wants money, they explain why, how the figure is worked out, and how to challenge it if you think it’s wrong.

Common HMRC scam formats to watch for

Scams are not just letters. The most common ones include:

- Texts saying you are due a tax refund, with a link to claim it

- Emails claiming your account has been suspended or flagged for fraud

- Calls saying you owe tax and will be arrested if you do not pay today

- Letters demanding immediate payment with threats of legal action

- The message is always the same. Act now or else.

What to do if you get a message like this

The most important thing is not to panic.

Do not click links. Do not reply. Do not call numbers or email addresses on the message.

If you are unsure, go directly to the official HMRC website by typing the address yourself, or check your personal tax account.

You can also contact HMRC using the phone number on GOV.UK, not the one on the message you received.

If it turns out to be fake, report it. HMRC has a dedicated way to report scam emails, texts and calls.

If you have already responded or paid

If you have clicked a link, shared details or sent money, act quickly.

Contact your bank straight away. The sooner you do this, the better the chance of stopping or recovering money.

Change passwords on any accounts that may be affected, especially email and banking apps.

Then report the scam to HMRC and Action Fraud.

Skint Dad says:

If a message about tax is designed to scare you into paying quickly, that’s usually your biggest clue it’s a scam. HMRC does not work like that.

A final reminder ahead of the deadline

The self assessment deadline is stressful enough without scammers piling on extra pressure.

Slow down. Read messages carefully. Trust your instincts if something feels off.

HMRC wants the right tax paid, but they do not bully, rush or threaten people into handing over money.

If in doubt, step away from the message and check through official channels. That pause alone can save you a lot of money and worry.

Mistakes and red flags in this HMRC scam letter

- The letter is dated January 2025, but it was received in 2026. An official tax notice would not arrive a year late with no explanation.

- It claims problems running up to July 2025. That date was in the future when the letter was supposedly written.

- It is headed “Tax Notice.” This is not how HMRC titles real letters.

- It talks about “taxation in the United Kingdom.” HMRC would not explain UK tax like this in an official notice.

- It refers to England rather than the UK. HMRC is a UK-wide body and does not single out England in this way.

- It includes a vague explanation of a US tax treaty. HMRC would only mention treaties if they directly applied, and with much more detail.

- There are no personal details. No name, no address, no National Insurance number, no Unique Taxpayer Reference.

- The language is threatening from the start. HMRC does not open letters by warning about prison.

- It mentions the “General Tax Code.” This does not exist in UK tax law.

- It quotes “Article 1728” and “Article 1741.” UK tax penalties are not written or referenced like this.

- The legal wording does not match UK systems. The structure is closer to overseas tax codes, not HMRC.

- The time period covered is odd and unclear. HMRC would always reference specific tax years.

- The phrase “regularise your situation” is used. This is not normal HMRC language.

- A large payment is demanded with no explanation. HMRC would explain how a figure is worked out.

- There is no information about appealing or querying the amount. HMRC always explains your options.

- It asks you to update payment details immediately. HMRC does not ask for payment details like this.

- It encourages direct contact by email. Serious tax matters are not handled through email conversations.

- The email address is a Gmail account. HMRC never uses Gmail or other free email services.

- The tone changes throughout the letter. Official HMRC letters are consistent in style and wording.

- It mixes civil tax issues with criminal threat.s These are handled through different processes and letters.

- The department name is vague; “Financial Investigations Department” is not how HMRC signs letters.

- The sign-off and job titles are unusual. Real HMRC letters use standard formats and roles.

- The signature looks theatrical. HMRC letters rarely include large handwritten-style signatures.

- There are spelling and phrasing issues. Small, but not typical of official HMRC correspondence.

- It pushes urgency without explaining next steps. HMRC does not rush people without clear instructions and timeframes.

Oh, and Jim Harra left HMRC in April 2025, but the scammers haven’t caught on that he’s retired.

If you missed some of these, you’re not alone. These scams are designed to look serious and overwhelming, so people act before thinking.

The key takeaway is simple. If a message about tax feels rushed, threatening, or asks you to pay or respond quickly, stop and check it through official HMRC channels first.

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- I was sent a fake HMRC tax notice. Here’s how to spot the scam - 8 January 2026

- A once-a-year money check most families forget (with rough savings) - 6 January 2026

- The January bills reality check: the traffic light method that works - 1 January 2026