Pocket money! Such a hit and miss subject, don’t you think?

With friends, days outs, an ever-growing list of technology wants and the dreaded mobile phone, kids seem to want it all nowadays!

Someone asked us the other day how much pocket money they should give their 16 year old, and I wasn’t able to give a proper answer.

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

Sure there are surveys from big companies who can tell us the average pocket money but, these surveys miss out on a big thing; budgets, the kid’s age, and behaviour.

What pocket money can YOU afford?

The thing is, it’s very personal to each and every parent.

And don’t let kids tell you otherwise – we’ve got the facts about pocket money from real parents.

While some may be able to afford it, other people’s budgets are so tight that a few quid a week in pocket money isn’t possible.

Be realistic in your approach and work with your budget.

- How much pocket money to give?

- Have you got spare money?

- What could you really afford?

- Is it one-off or could you afford it all the time?

Do other parents give pocket money?

Now don’t read into this thinking you should start giving children pocket money if you can’t afford it.

However, if you are giving some money each week, it may be helpful as a guide to see how you compare to other parents who give pocket money.

We put the question to our community and over 240 parents gave us a response, with 36% of people telling us they give less than £5 a week.

Some do give a little more, with 26% of people saying they give between £5 and £10 per week.

It matches quite closely with a survey from Halifax which shows the average weekly pocket money is £7.04.

This does change a fair bit depending on the ages of the child. Younger kids get far less (if anything at all) but older kids and teens tend to get more.

It’s not just about money

Not everyone has money to give, or even believe in pocket money as 7% of parents told us they give nothing.

5% of parents give small treats like magazines or sweets instead of cash.

If you still want to give pocket money, how about trying to put it into a child savings account instead of letting them have direct access to spend it?

Do you pay for their mobile phone? School dinners instead of packed lunches? Spur of the moment purchases of clothes? Trips to the cinema?

If so, then you may not want to give much more cash on top as you’re already spending a fair whack on them as it is. Do make sure to take into account anything you’re already buying.

Sneaky tip: work out how much you’re spending and give it to them as cash. They can then get their cash but have to budget and spend it responsibly. Giving pocket money can help them learn the value of money. This will also stop you from having to give them any more than you already were.

The best thing you can do is look and your budget to work out what you can afford – and don’t let your children tell you how much they think they should be getting!

How much pocket money we give

Our daughters have big age gaps.

Trying to find things to do to keep them entertained can be a chore and they are all at very different stages of development so want different things.

Back when I was a kid, I was working at 15 and paying for everything myself. It was certainly a good lesson on how to earn money and it’s the same kind of lesson I’d like my kids to have.

I don’t want them to feel that they can be handed everything on a plate. They need to contribute and make their own way in this world.

Pocket money for a 6 year old

Our youngest doesn’t really want pocket money as such.

She asks for chocolate and sweets at the shop and asks for the occasional magazine when she sees them. But this doesn’t mean she gets them every time.

We don’t give her any physical cash as pocket money as there is nothing for her to spend it on.

If she does get any money from family, we look to put it into her bank account and if she really wants something big, she could get it herself. But this has never happened.

So, we do spend money on her, maybe less than £5 a month, but that could come into our usual grocery spending and we could have some treats in the cupboard instead.

Unsure if not giving her any pocket money is the right thing, I thought I’d ask her.

I simply said: if we started giving you pocket money each month, what would you do with it?

She told me she would get some little toys. She told me it’s cause she has just donated her older toys to charity and wants some new ones. Then, she would start to save her money and buy a big expensive My Little Pony toy.

But I don’t think she really wants pocket money. I asked if she’d give me a foot rub and I’d give her money for sweets and she said no, thanks.

Pocket money for a 13-year-old

The teenager has a lot more wants.

She really needed a mobile phone. After a lot of thinking, we decided to get her one as she was walking to school on her own (or with friends), so we could check she was ok.

There are times when she does things with friends and because this is little and often, we’ll give her a bit of cash for the bus (although, between other parents, we end up giving them lifts home).

Knowing that she’ll want to spend more as time goes on, we have started to transfer £5 a month into a bank account for her.

She has access to the pocket money and will usually use it to get gifts for her friends for Christmas or birthdays.

It may not be a massive amount, but considering we pay for her phone as well, it’s fine for her.

Related Post: 30+ Teenage Activities and Ideas for Keeping Teens Busy, Safe and Happy

Pocket money as they get older

As our children get older the amount they get will likely go up, but we expect more from them in return.

This doesn’t mean we’ll be giving them more cash. Children need to learn there is a family household budget, so they can appreciate it themselves when they’re older.

Getting more

We would prefer them to have more experiences, so will support them if they want driving lessons, or a car (!), or tickets to a theme park.

Unless we win the lotto we won’t be splashing the cash and paying 100% but we will offer a contribution.

For instance, they can go and earn or save half of the money and we will match the other half. Children learn a better appreciation for earning money.

Contributing back

It then comes to the point when you start asking them to contribute back to the households they can understand the value of money.

If they get part-time jobs, then we’d expect, straight away, a contribution from their pay to support, as well as making sure they keep an allowance to spend and have their own savings.

We’d also want to see them pay for their own extra toiletries (things above and beyond what we usually buy).

Pocket money chores

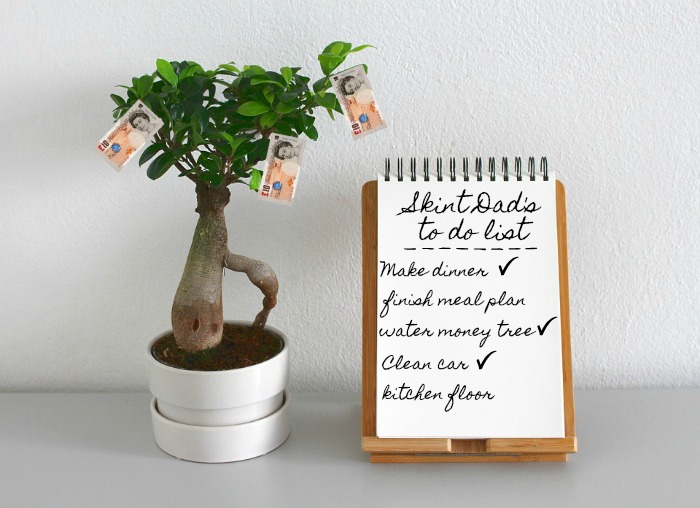

Money doesn’t grow on trees (but how I wish it did!!)

It’s one lesson I wanted our children to learn quickly.

I remember our youngest suggesting to “go and get some more money out of the machine” when I said I didn’t have enough change to buy her a magazine from the shop. She was far younger than she is now, but it was a perfect example to teach her about where the money comes from and that jobs pay the bills.

She wasn’t too impressed…but it’s something she needed to understand.

Rather than waiting for your child to work for their own money when they’re older and getting a culture shock, it doesn’t hurt them introducing the idea of getting a treat in return for chores, services or contribution to the house.

Read next: 20+ new ideas of how to make money as a kid

When it comes to what other parents do 21% of those we surveyed said they only give a few pennies in exchange for jobs.

So, not only are other parents not really giving any money, they expect help around the house anyway.

It doesn’t have to be big things either.

Here are some of the things our girls help with:

6 year old chores

- Setting the table for dinner

- Tyding up in the living room and bedroom

- Make her bed

- Put washed clothes away

13 year old chores

- Taking out the rubbish/recycling on bin days

- Washing up

- Vacuuming

- Hanging up washing

Spending vs saving

Financial education can start at home – as early as possible.

From counting pennies to explaining the electric bill, there are all sorts of things you can teach your kids about money.

We think it’s really important to encourage children into the mindset to save and discuss how to save with our kids often.

While it’s nice for them to get a treat, having cash on hand may seem like a temptation (I know it has been in the past for me).

Because of this, we will make sure to keep transferring any pocket money directly to their online bank accounts. This way, they can check their balance with the bank and can track any spending on their statements.

When it comes down to it, no matter how much a child wants for pocket money if YOU cannot afford to give it then don’t.

There is no point stretching your budget if there is no wiggle room.

Have a conversation with your child and explain budgeting. Maybe get them to go through the ins and out with a calculator together so they understand it better.

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- I was sent a fake HMRC tax notice. Here’s how to spot the scam - 8 January 2026

- A once-a-year money check most families forget (with rough savings) - 6 January 2026

- The January bills reality check: the traffic light method that works - 1 January 2026