Klarna has launched a brand-new debit card in the UK. On top of that, it now offers four paid membership tiers that promise cashback, travel perks, subscriptions and even airport lounge access.

On the surface, it all sounds exciting. But do these perks actually save you money, or do they just add another monthly bill to your life?

Here’s everything you need to know before signing up.

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

What the Klarna card is

The Klarna card is a Visa debit card you apply for through the Klarna app. You get a free digital version straight away, but you only get a physical card if you join one of the paid membership tiers.

It links to something called your Klarna balance. This is an e-money wallet where you add money yourself. You then spend from that balance like any normal debit card.

Klarna also lets you apply for its buy now, pay later options, such as spreading payments over three instalments with Pay in 3. You must pass checks before using credit.

A handy feature is that the card has no foreign transaction fees when spending abroad.

One thing the card cannot do yet is handle direct debits or standing orders, or give you an account number and sort code.

It’s mainly for day-to-day spending, although Klarna plans to grow into a full bank in the future.

Is your money safe?

Klarna is authorised as an Electronic Money Institution, not a bank. This means your money is protected in a special safeguarding account, but not by the Financial Services Compensation Scheme.

If Klarna ever collapsed, you should get most of your money back, but the process could take longer, and some administrative fees may be taken off.

Klarna purchases made using the debit card are covered by chargeback rules, but buy now, pay later purchases do not come with Section 75 consumer protection.

That won’t change until BNPL regulation begins in July 2026.

What Klarna memberships offer

Klarna has four membership tiers: Core, Plus, Premium and Max. All four give you a physical card and various perks.

Here’s a simple breakdown of each tier.

Core (£1.99 a month)

Core is the cheapest option. You get:

- a physical Klarna card

- up to £15 in exclusive monthly discounts with selected retailers

Plus (£7.99 a month)

Plus includes:

- 0.5 per cent cashback when you pay using your Klarna balance

- £8 credit every three months

- up to £80 in exclusive monthly discounts

Premium (£17.99 a month)

Premium adds a long list of subscriptions. Depending on availability, these can include Blinkist, Headspace, Laundryheap, MasterClass, The Times and Sunday Times, Vogue and GQ, ClassPass and Clue.

You also get:

- 0.5 per cent cashback

- global travel insurance

- a 2GB travel eSIM

- a 16g metal card

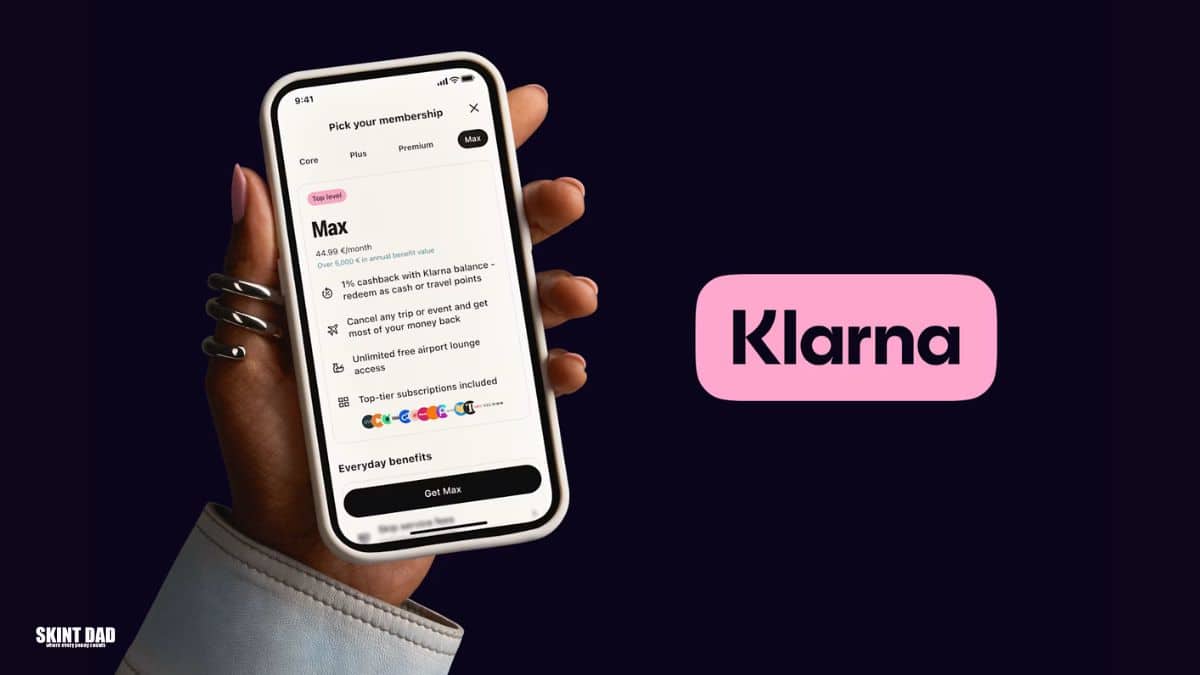

Max (£44.99 a month)

Max is the most expensive tier and includes everything from Premium, plus:

- 1 per cent cashback

- stronger travel and rental car insurance

- a 5GB travel eSIM

- unlimited airport lounge access at more than 1,600 lounges worldwide

- an exclusive 16g rose-gold metal card

You also get extra subscription options like A Small World and Audiobooks.com.

Will the card appeal to UK shoppers?

Klarna says its card launch in the US saw one million sign-ups in just a few months. The UK is one of Klarna’s biggest markets, and the company hopes the new card will take off here too.

Because the UK is a debit-first country, Klarna offering both debit and credit in one place could make it attractive to some shoppers.

When Klarna membership might be good value

A membership could work for you if:

- you already pay for several of the included subscriptions

- you travel often enough to use airport lounges

- you want travel insurance, and the policy suits your needs

- you regularly shop with the discounted retailers

If you tick more than one of these boxes, you might save money.

But for most households, the value is limited.

Skint Dad says:

If you have to squeeze your budget to afford the perks, then the perks are eating your savings.

When it’s probably not worth it

Most people will not use enough of the perks to justify the monthly cost.

The cashback rate is low compared with other reward cards, and many of the included subscriptions are things people wouldn’t buy in the first place.

The metal cards look nice, but do not offer any real financial benefit. Unless you travel often and value every perk, the cost can outweigh the rewards.

Tips before signing up

- check whether you already pay for any of the included subscriptions.

- read the travel insurance details to make sure it fits your needs.

- avoid keeping large amounts of money in Klarna balance, as it is not FSCS protected.

- use reminders if you use Klarna’s BNPL options to avoid late payments.

- compare with packaged bank accounts, which may offer stronger cover for a similar price.

Final thoughts

Klarna is trying to grow from a buy now, pay later service into something closer to a bank. Some perks look exciting, but the memberships are expensive and won’t suit most households.

If you want a free debit card with no foreign spending fees, the basic Klarna card could be handy.

Anything more, and you need to weigh up whether the perks genuinely help your budget or just add another monthly cost.

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- Side hustles and benefits in the UK: what you need to know - 8 January 2026

- Lloyds Bank switch deal: grab £250 plus Disney Plus for free - 6 January 2026

- Thinking of doing the Co-op freezer deal? Read this first - 6 January 2026