Lowell Portfolio I Ltd has lost its FCA authorisation, but this doesn’t mean your debt is wiped. Here’s what the change actually means, why your repayments still matter, and what to do if you’re unsure.

If you’ve spotted posts flying around Facebook about Lowell Portfolio I Ltd losing its FCA authorisation, you’re not alone.

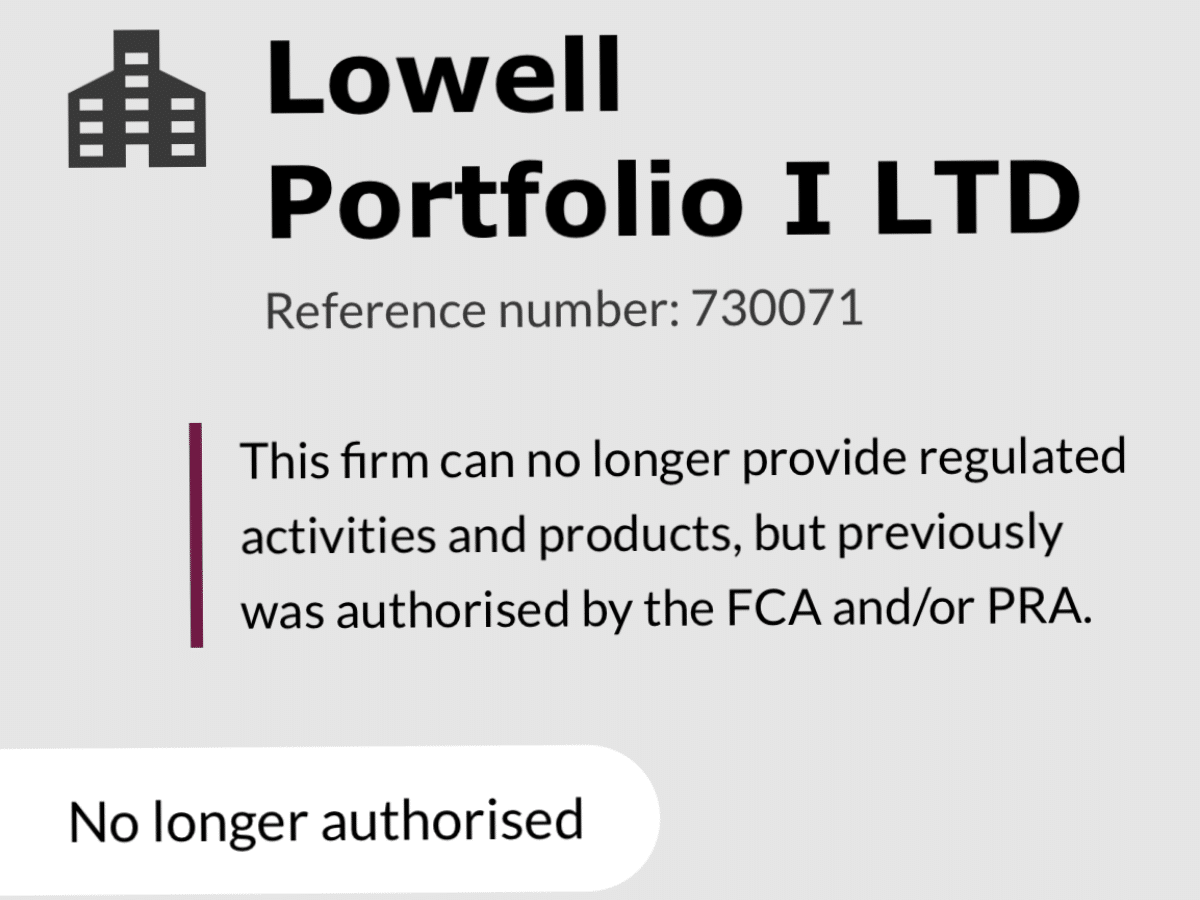

From 18 August 2025, the company can no longer provide regulated activities or products. That’s triggered a lot of panic, with people wondering if they can cancel their Direct Debits or if their debts have been written off.

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

The short answer? No, your debt hasn’t disappeared.

Who Lowell Portfolio I Ltd actually are

Lowell operates several companies under the same group.

It can get confusing, but here’s the simple breakdown:

- Lowell Portfolio I Ltd – this company buys and owns debts.

- Lowell Financial Ltd – this company manages and collects those debts from customers. (This part of Lowell is still authorised and regulated by the FCA.)

- Overdales Legal Ltd – their in-house solicitors who deal with court action if debts aren’t repaid.

So, while Lowell Portfolio I Ltd itself is no longer FCA-authorised, the collections and enforcement side is very much still operating.

Can you stop paying Lowell?

In almost every case, the answer is no, you shouldn’t stop paying.

- If you have a repayment plan set up, whether by Direct Debit, standing order, or another method, you still owe the money.

- If you cancel your payments without an agreement in place, you could face:

- Additional fees or penalties.

- Damage to your credit score.

- Possible legal action, including a County Court Judgment (CCJ).

The debts owned by Lowell Portfolio I Ltd are still legally enforceable. If you’re ever in doubt, get written confirmation from Lowell before making any changes.

Skint Dad says…

“There’s a lot of noise on social media about Lowell losing its FCA authorisation, but this isn’t a get-out-of-debt-free card. If you owe them money, you still need to deal with it as ignoring it could make things worse.”

Why Lowell lost FCA authorisation

This isn’t about Lowell “going bust” or debts being wiped. At a guess, it’s likely an internal restructuring:

- Some companies in the Lowell Group hold the debts (like Lowell Portfolio I Ltd).

- Others collect the debts (like Lowell Financial Ltd).

- If a company doesn’t directly deal with consumers, it doesn’t always need FCA authorisation.

The key takeaway is that the business hasn’t stopped collecting debts; they’re just handling it through their other FCA-regulated companies.

What to do if you’re worried

If you’ve seen the news and aren’t sure what it means for you:

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- Don’t panic – losing FCA authorisation doesn’t mean your debt is wiped.

- Keep making payments – unless Lowell tells you otherwise in writing.

- Check who you’re paying – your statements should show if payments are going to Lowell Financial Ltd.

- Ask for written confirmation – you have the right to request a statement of account showing:

- Who owns the debt.

- How much is owed.

- Who is collecting on their behalf.

- Get free debt advice – speak to StepChange, National Debtline, or Citizens Advice if you’re struggling.

- I was sent a fake HMRC tax notice. Here’s how to spot the scam - 8 January 2026

- A once-a-year money check most families forget (with rough savings) - 6 January 2026

- The January bills reality check: the traffic light method that works - 1 January 2026