Automate your savings and get some of the market’s best interest rates. Tried and tested feedback from real people on how the app works.

Even if you’re paying off debt, trying to save a bit of money each month is really important. You need to have a little stashed away to cover things you’ve not got included in your day to day budget.

Like what if your fridge freezer packed in? Or what if your child’s school shoes came apart and sound like flip flops when they walk?

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

This is where Chip comes in to make finding money at the drop of a hat not as hard.

The Money Advice Service has said there are 16 million people who have less than £100 saved. If you’re one of those people, then it can be really easy (it really can) to start getting a small pot of money put aside.

In fact, it’s even easier if you automate your savings with an app like Chip.

How does Chip app work?

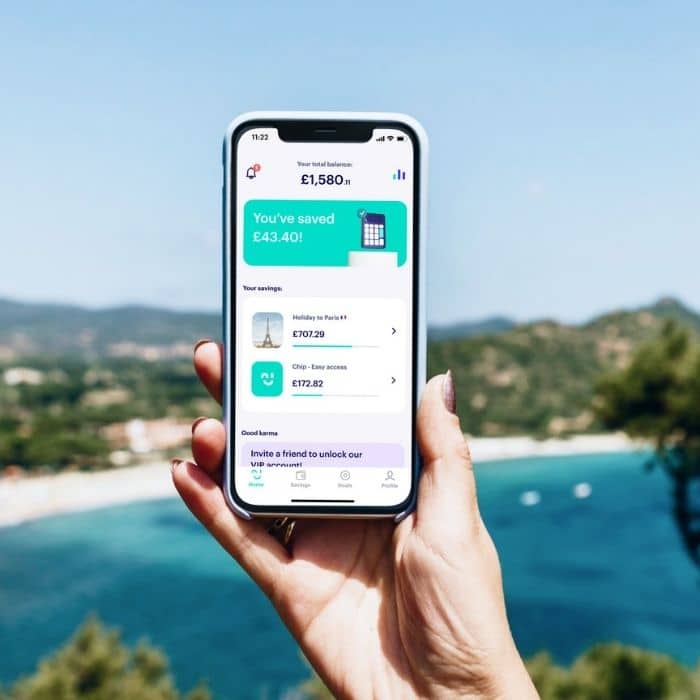

Using Chip AI you can automatically grow your savings. It calculates how much you can afford to save and automatically saves that money for you in your Chip account.

After you link your bank account, it uses clever algorithms to work out how much money you won’t miss, making sure you’ll have enough money until the next payday. It even works if you don’t get paid regularly.

They look at how much you spend on direct debits/standing orders and general card payments/cash withdrawals to see how you can build your savings without feeling it.

Your transfer could be as little as a few quid or even around £50, depending on how much spare cash they think you can afford (and how much you’ve got in your bank). The average saving is around £20, and the average Chip saver puts aside £1,800 a year – all without noticing! It really is clever stuff!

Over 400,000 people save with Chip, and (as a Chip saver myself) we collectively save millions a month!

You’re able to start saving if you’ve got an account with Bank of Scotland, Barclays, Danske, First Direct, HSBC, Halifax, Lloyds Bank, Marks & Spencer, Monzo, Nationwide, Natwest, RBS, Revolut, Santander, Starling, TSB, Ulster Bank.

Find out about other money savings apps.

Can I earn interest on my savings?

Chip offers the market’s best interest rates of 4.84% AER as an easy access account.

You earn interest daily, and it compounds, meaning you earn interest on interest.

As the account is easy to access and you can move money in and out whenever you want.

The account is powered by Allica Bank and is covered by FSCS protection up to £85,000.

Chip Prize Savings Account

You can use their automated savings to win prizes, rather than gain interest using their other account.

The account is similar to the NS&I Premium Bonds in that you hold a balance and have a chance to win a prize each month rather than getting guaranteed interest.

You have the potential to win a grand prize of £20,000 each month you hold a balance.

There are other prizes of £100, £50, £25 and £10.

So far, I’ve won £25 on the account and have had it open since September 2022, although I have taken money out (I reached my saving goal, so I spent some!)

Other savings accounts

You also have the option of investments and can open a General Investment Account. Remember that with investing, your money can go down as well as up.

Chip also offers a Cash ISA with 4.75% AER (variable) interest for ChipX users (see below). You have a maximum allowance of £20,000 to save.

You can access your money at any time with no penalties for withdrawing it.

Plus, it’s a flexible ISA, meaning that any withdrawals do not affect your allowance, and you can add money back in during the same tax year.

Is Chip bank safe?

Chip is a safe app to use.

Having used the app for more than four years, we’ve had absolutely no issues!

It accesses your bank as read-only, so it isn’t able to do anything to your account other than review your transactions (to see how much you can afford to save). The savings get transferred via a direct debit which you agree to as part of setting up your account.

When you connect your online banking login details, they are protected using 256-bit encryption, and Chip does not store your data, which is the same level of encryption as banks use.

Chip is authorised by the Financial Conduct Authority under the Payment Service Regulations 2017 no. 911255 for the provision of payment services.

Money in a Chip savings account is safely held in an FSCS eligible savings account, meaning your savings are governments backed up to £85,000.

Chip plans – how much does it cost?

The Chip bank app is free to download and use.

I use the free version, and it works fine for me. WIth this, you get access to their savings account and the Prize Saving Fund, as well as their GIA.

However, if you use their automated savings tools, you need to pay a small fee.

If you set up a recurring payment (like a regular standing order), you need to pay 25p for the transfer.

Also, the AI automatic saves are 45p, but I find this takes all the hassle out of remembering to save anything in the first place.

In February 2024, for four saves a month, it cost me £1.80, which I am not concerned about.

If you don’t want to pay the small fees, you can manually add money instead at no cost.

ChipX

ChipX is a paid plan costing £4.99 a month.

You get everything the same as the free Chip plan, with the benefits of zero platform fees if you invest and unlimited autosave for free.

There is also a mention of access to higher interest savings accounts too.

Chip reviews from real users

Don’t just take our word for it!

Here are a few comments from people who started using the app when they found out about it on Skint Dad:

With a new house, recent wedding and baby to pay for I really didn’t feel I had any spare money to save but having chip has made it really easy to ferret away several hundred pounds already, seriously without me noticing.

Victoria

Savings were always one of those things that I knew I should have, but never quite got round to doing…that was until I discovered Chip! Now saving has never been easier!

At first I was dubious about the amounts the Chip algorithm was calculating, I thought there was no way I could afford to save that much on a regular basis. But it turns out I was completely wrong, I now have a steadily growing savings account with Chip!

Ashley

Chip has really helped me to save and buy things I wouldn’t have purchased otherwise, kept the Mrs happy with the new furniture. I wouldn’t have used it without Skint Dad’s recommendation. Now I use the app all the time!

Mike

Thanks to Ricky at Skint Dad, I’ve managed to save around £200 in a few months without even noticing, which is pretty awesome for someone as bad with money as I am! Chip is easy to use and a great pain free way to start accumulating a wee nest egg, and I especially like that you can save even if you’re overdrawn. Recommended.

Amanda

I struggle to save a regular amount each month so therefore never really saved. I never noticed or miss the money that Chip saves and it soon mounts up, I’ve recommended it to everyone as it’s a fantastic and easy way to save (particularly for lazy people like me!). Huge thanks to Chip as the money I’ve saved will pay for my car insurance all in one go (first time ever), car service and spending for my holiday, happy times!

Kay

How do I withdraw my money?

You can see your money going up, and you’re able to withdraw your cash from your Chip wallet or Interest account whenever you want (which is when the chart goes down).

If you need your money (perhaps you’ve hit your savings goal or need it for an emergency), then you can request to withdraw as much as you need from the Chip app.

Ask before 2 pm on a weekday, and you will get your money back into your bank account on the same day. If it’s after 2 pm or at the weekend, then your money will be back in your bank account the next working day.

Withdrawals take between 1 to 2 working days to complete and for the money to reach your linked bank account.

What if I have an overdraft?

You can choose to make savings even if you are in your overdraft. This option is off as standard, so it’s something you will need to turn on if you plan to use it.

Overdraft charges are HIGH. Did you know that they are usually higher than a credit card?! They are really expensive.

The best thing would be to look to clear them. I know all too well how hard it is to get rid of that overdraft.

One option is to use Chip to save while in your overdraft. When you get to, say, £100, you can transfer it back to your current account to start clearing your overdraft.

When trying to clear my overdraft, I felt having the money in my main account was too much of a temptation. By saving the money elsewhere, it was out of sight, out of mind.

Clearing off a little every few months, the interest would slowly come down, and I could see the light at the end of the tunnel.

You can choose to disable overdraft savings if you want to.

Chip Overdraft Guarantee

They are so sure of the algorithms that they promise to never intentionally go into your overdraft and leave you short of cash.

They are so confident about this that they’ve set up the Chip Overdraft Guarantee. If they ever make an automatic save and it causes you to go into your overdraft, they’ll deposit a £10 savings bonus in your account to say sorry.

However, please note, if you’ve selected the option in the app to save into your overdraft (see point above), then the overdraft guarantee doesn’t apply.

How do I save less?

Chip works out how much it thinks you can afford and makes a save once a week or so.

However, if you feel that the app is saving too much, then you can change the savings level within the settings.

You’re also able to pause the option to save if you need a break.

In the same way, you can increase your savings level if you feel you can afford it. If you want or can afford it, you can also add up to £100 a day manually (up to 6 times a month).

Can I talk to someone?

All customer support is built into the app.

Instead of having to call the bank and wait on hold, you’re able to start a live chat.

It’s open from 8 am to 5 pm during the week, and they’ve always got back to me quickly.

If I messaged over the weekend, I usually get a response early on Monday morning.

Final thoughts on the Chip app review

Having used Chip for ages now, I love the fact that it makes saving really easy.

Because I haven’t been saving much money each time, I didn’t miss the cash from my bank account, but it really adds up quickly. Within a few months, I had hundreds of pounds stashed away!

Saving using Chip has made me feel that saving money is possible and achievable.

I just wish I started using it earlier.

Download the app on either the iTunes Store or on Google Play, and start saving like you never have before!

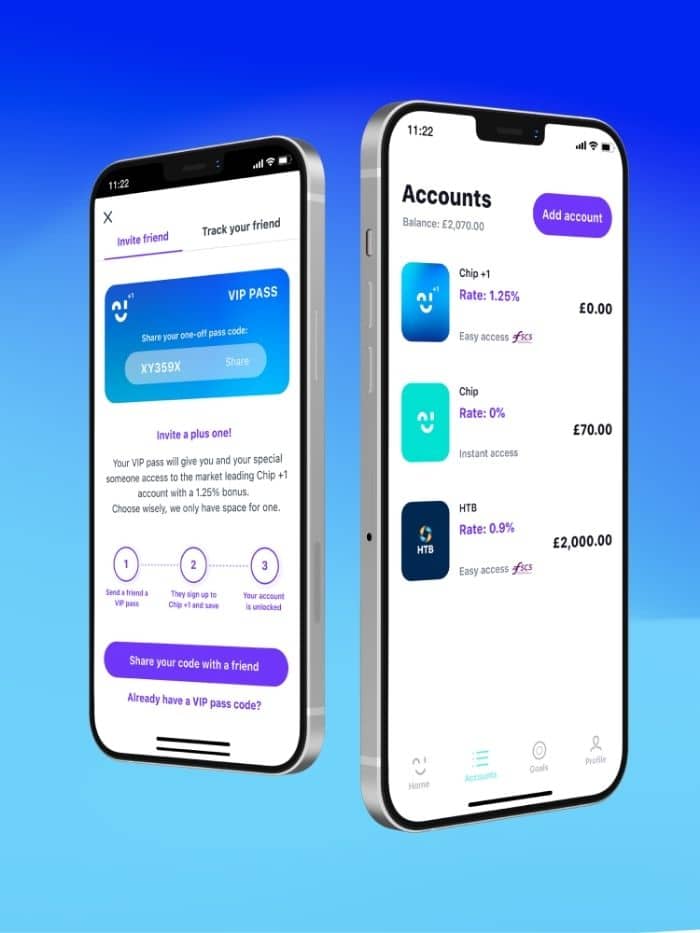

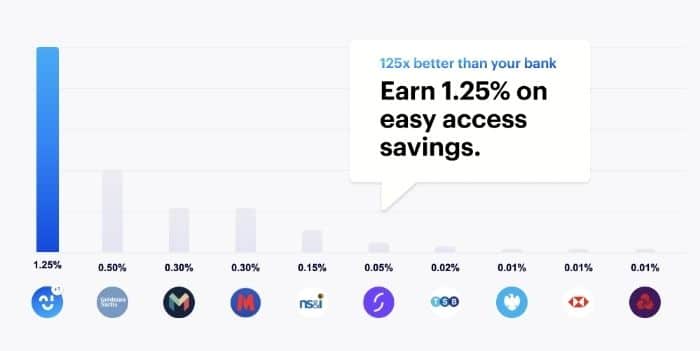

Closed to new users: Chip+1 – savings account pays a bonus of 1.25% (variable)

Chip+1 is an easy-access savings account with the market’s leading return (1.25% variable).

Chip+1 has around 100 times better returns than most high street savings accounts.

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- I was sent a fake HMRC tax notice. Here’s how to spot the scam - 8 January 2026

- A once-a-year money check most families forget (with rough savings) - 6 January 2026

- The January bills reality check: the traffic light method that works - 1 January 2026