Complete Savings is a cashback service that charges £18 a month after a 30-day free trial. Many people sign up without realising via checkout offers on popular sites.

Complete Savings is a cashback service offering at least 10% cashback on purchases. While this sounds appealing, it’s important to understand the costs and how you might unknowingly sign up.

If you are subscribed to Complete Savings, you’ll see charges on your bank statement listed as “WLY*COMPLETESAVE.CO.UK” or “completesave.co.uk”.

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

It may even show as CASH.COMPLETESAVE.CO.UK or GO2.COMPLETESAVE.CO.UK.

These charges can be surprising (frustrating, irritating, aggravating, upsetting, annoying – you fill in the blank as you need!) if you don’t remember signing up.

How can you sign up without realising?

Many people sign up for Complete Savings without even knowing it.

This would have happened after making a purchase on another website.

Websites I’ve seen that do this are Argos, Trainline, National Rail, eBay and more! There are around 150 companies that advertise them, and all because they earn money when you sign up.

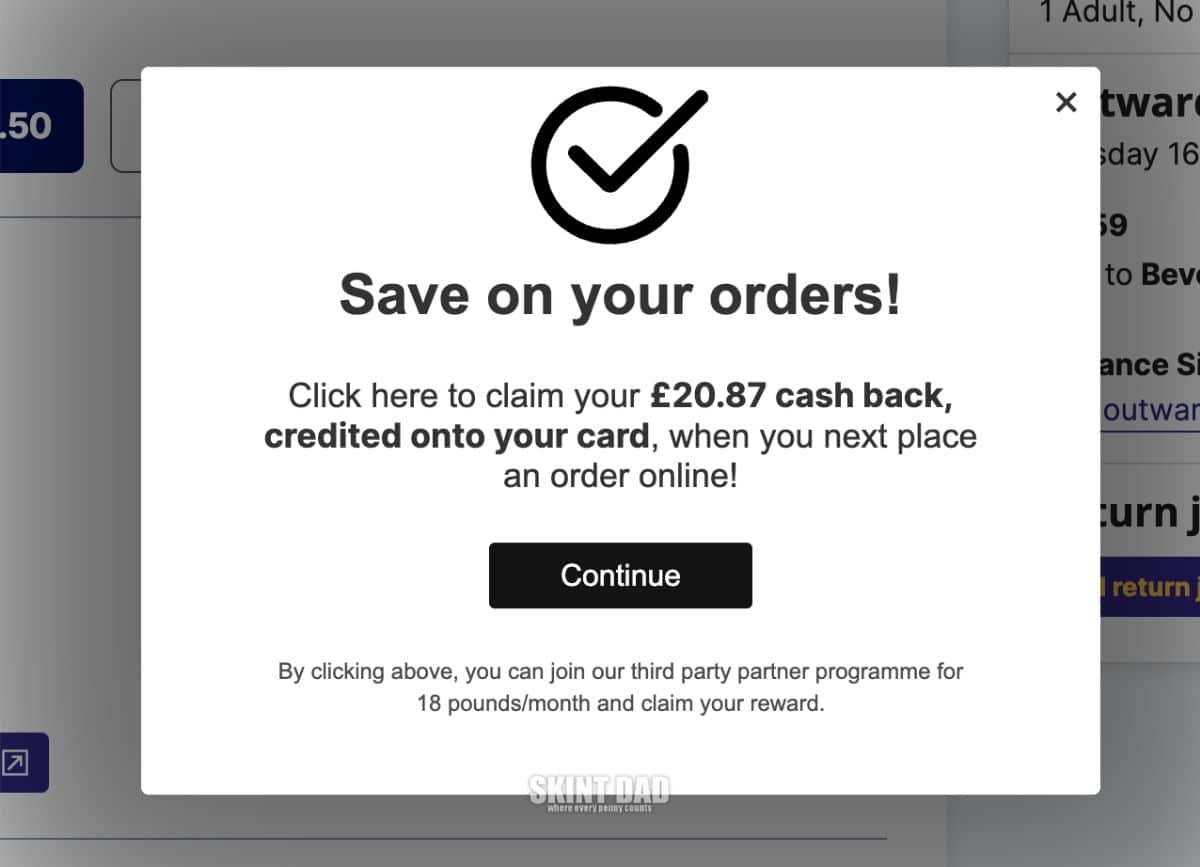

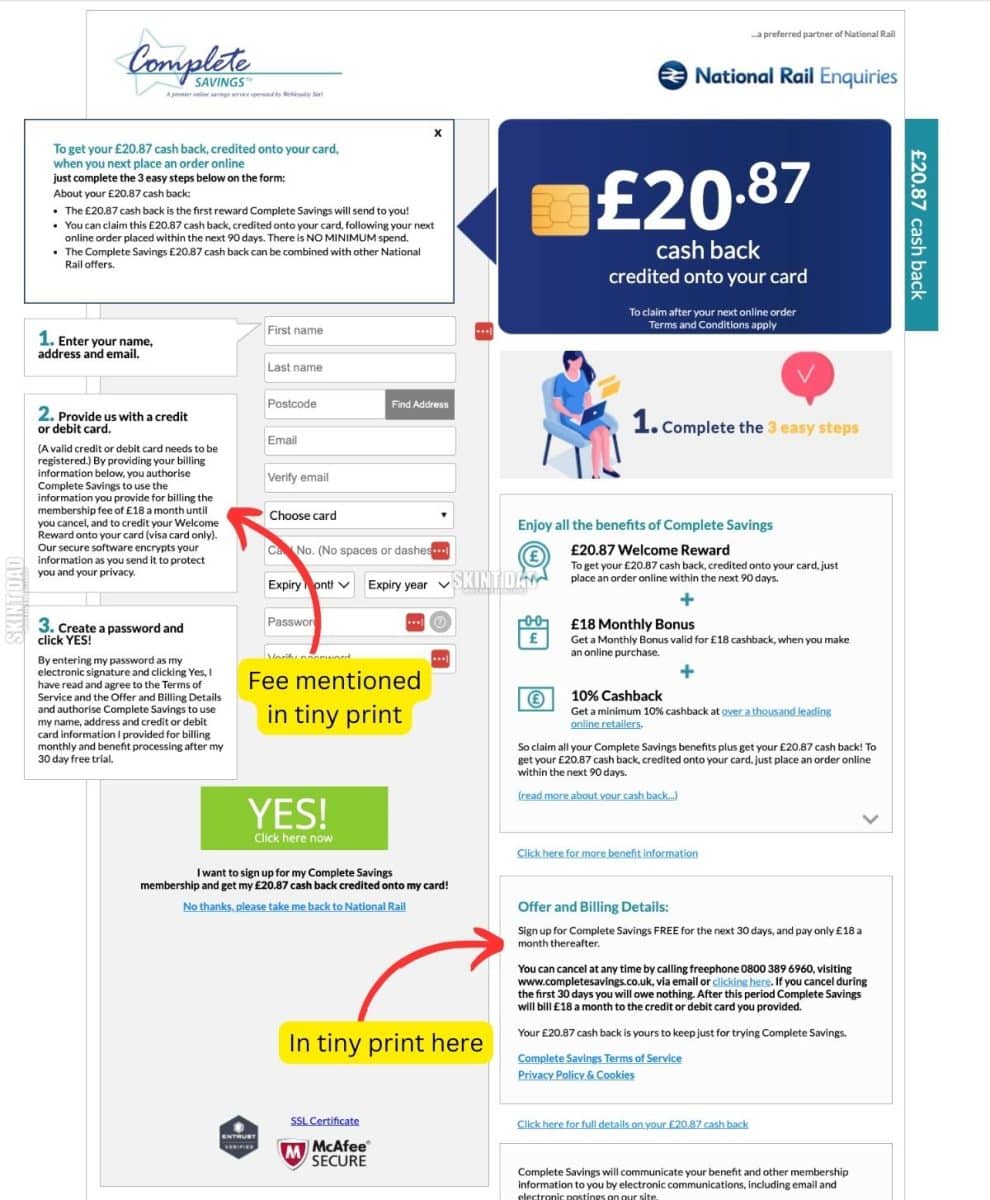

What happens is during the checkout process, you may have seen an offer flash up.

It almost looks like it’s from the retailer themselves, but it leads you to sign up for Complete Savings without fully understanding what it is.

Here’s an example of what you may have seen. It’s big, takes over the screen, and is compelling you to get money for free.

What to do if you didn’t know you signed up

The first point when people realise that they’ve signed up is a £18 charge on their bank statement.

This will happen 30 days after you first signed up, so if you’re like me, you might have forgotten what site you first found it on.

How to cancel

If you find charges from Complete Savings and didn’t realise you signed up, you can request a refund.

Contact their customer service team by emailing customerservice@completesavings.co.uk or calling 0800 389 6960 (Monday to Friday 8:00am – 8:00pm and Saturday 9:00am – 4:00pm).

What is Complete Savings?

Complete Savings is a cashback service where you can earn at least 10% cashback on your purchases.

This is higher than many other cashback providers.

However, there’s a catch: after a free 30-day trial, it costs £18 a month to access their offers.

You need to decide if the membership fee is worth the extra cashback.

You cannot sign up with them directly, though. You only get an account if you make a purchase through one of their partner sites.

Is Complete Savings Legit?

Yes, Complete Savings is a legitimate service.

However, many people don’t realise they’ve signed up, which can be a concern and a bit of a con.

Their sign up process doesn’t make it overly clear either.

It’s in the small print, much lower on the page. I know we’re all meant to read the small print, but the sign up screen screams that you’ll get £20 credited as free money (which is why you put your card details in), and most will skip past that you’ll actually need to pay going forward).

While there are a lot of bad reviews out there (due to people being miffed at being charged), there are also good reviews if you know what you’re signing up for.

One user shared with us:

“I have had well over a grand from this website and never paid them a membership fee.

“Use the free trial by spending 20p on eBay and you get the £20 welcome bonus then spend another 20p and you get the monthly bonus of £18.

“Then you use the account to do your normal spending. You get at least 10% back. Cancel the membership before the expiry.”

If you see charges and don’t recall signing up, you likely did so while making a purchase on another site and didn’t notice the details.

Complete Savings offers substantial cashback, but the monthly fee might not be worth it for everyone.

Always be careful when signing up for offers online to avoid unexpected charges.

Free alternatives to Complete Savings

There are many free cashback sites you can use, such as:

- Quidco: A popular cashback site that’s free to use, though they also offer a premium service for extra benefits. We have an exclusive FREE offer – get £16 cashback bonus when you spend £5, plus any cashback you earn (free to sign up, no subscription).

- Swagbucks: Earn cashback, gift cards, and more through various online activities, including shopping. Plus, you can earn a £10 sign up bonus when you sign up here (free to sign up, no subscription).

- TopCashback: Offers a wide range of cashback deals without any membership fees.

These alternatives don’t have monthly fees, making them a good choice if you want to save money without the commitment.

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- I was sent a fake HMRC tax notice. Here’s how to spot the scam - 8 January 2026

- A once-a-year money check most families forget (with rough savings) - 6 January 2026

- The January bills reality check: the traffic light method that works - 1 January 2026