There was a time when we’d never talk about money – not even to each other.

I remember times when we’ve been in a supermarket and started to have a panic. We’d added things to the shopping trolley above and beyond our list.

When we got to the checkout, having not added up along the way, anxiety started to set in that we wouldn’t have enough to pay for everything.

I’d ask Skint Mum if we had enough in the bank and she’d shoot me a look. I clearly knew she was giving me the “death stare” which meant “Do not talk about our finances in public!”

She didn’t want our dirty laundry aired for other random people to hear that we were struggling.

£10 sign up bonus: Earn easy cash by watching videos, playing games, and entering surveys.

Get a £10 sign up bonus when you join today.

Join Swagbucks here >>

I suppose it was a little bit like burying our heads in the sand. We didn’t really discuss money too much in the hope it’d all work out ok in the end.

But it didn’t.

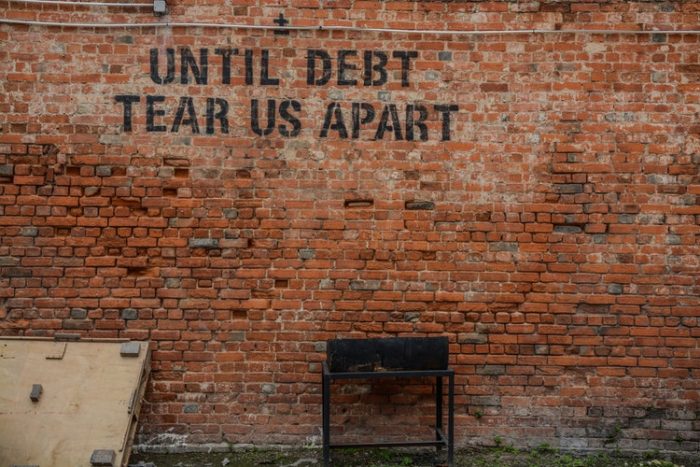

Our finances and our debt kept getting worse and worse.

We didn’t really know how bad it was getting because we didn’t communicate with each other.

It was only when things truly hit rock bottom that we realised we needed to face up to what was happening and open up to each other.

Telling other people

After working out how badly we were in debt (around £40k!!) we needed to start talking to other people about it.

I tell you, these conversations were some of the hardest and most soul-destroying of my life.

After speaking to a debt charity, we knew our situation was dire, but we had to do something about it.

We began to call each and every creditor and tell them the same thing:

- We’ve messed up

- We’ve been ignoring it

- We’re skint

- But we want to fix it

- Please accept our offer of a repayment

At first, it was such a hard thing to do, but after the first few times, it began to get easier.

Each time we told someone what was happening, a small weight lifted from me. I was finally acknowledging there was an issue and I was doing something to sort our lives out once and for all.

Telling the world

We went one step further than just telling our creditors and people close to us.

We decided to tell the world.

In an open and honest blog post, we laid out our issues and how we got into such a pickle.

My wife wasn’t too pleased I shared so much, but she ended up being very grateful.

If it wasn’t for us sharing our story, we would not have had the courage or strength to keep going.

We were inundated from kind messages from people all over the world who weren’t looking to judge us or tell us we were stupid. They wanted to offer tips, guidance or just a few supportive words to keep us on track.

If it wasn’t for opening up, we may have got disenfranchised with paying off debt and fallen back into our old ways.

With a group of supportive people in a community talking to us, we found the drive and determination to stick it out, continuing sharing what we were doing well, and what we were doing badly to get rid of debt for good.

It’s worth it

While you may not want to shout your debt issues and money worries to the world and his wife, it really is worth having conversations about finances.

I promise you, as soon as you start talking about money, things start to get better.

Debt charities can give you advice on how to get debt free or manage your budget better, so you have more left over.

If you’re facing crippling debt, solutions can be found (that you never thought existed) to help get you debt free.

A hard one is talking to people you love, but you’ll be surprised how supportive they are.

While you may feel like it’s a difficult conversation, talking to friends and family can help remove burdens you may feel about spending money.

You may feel you have to buy birthday presents or go on expensive nights out with friends. When they know that you’re struggling, you’ll be able to work on solutions together, so you can spend less, but still spend time together.

Just talk

There should be no stigma around talking about money.

We may think we have a stiff British upper lip, but we need to break it down and just share – the good and the bad!

To help get more people talking, the Money Advice Service is launching Talk Money Week.

The awareness week will simply encourage people to have open conversations about money. Having a chat about your finances can give you the opportunity to improve your own financial well-being, and stop you hiding your worries under a rock.

That first conversation may be hard but, once you’ve started talking, you will feel a burden lifted and can start taking steps to sort out money worries.

Whether you want to talk about debt, like we have, or you want to talk about using credit, pocket money, financial education, savings or even retirement, Talk Money Week is a perfect opportunity to get talking about money.

Talk Money Week runs from 12-18 November and there will be will events and activations all across the UK to help you open up about money and your finances.

So, please, use this as an opportunity to change how you feel about money.

Don’t bottle it up, grab a cuppa and have a chat with your friends, family (or even us) about your feelings about money.

Also, please do share your thoughts about money on social media using the hashtag #TalkMoney.

Written in association with the Money Advice Service

Leave a Reply