As the cost of living soars across the UK and the wider world, it’s never been more important to stretch your money as far as possible, and the best way to do that is to focus on frugal living.

A practice often incorrectly paired with a reluctance to spend your cash, in truth, frugal living ideas should be matched with terms like “common sense” or “value for money”.

So, in the spirit of common sense, the Skint Dad experts have dug deep into the memory bank and withdrawn the following pound-stretching tips.

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

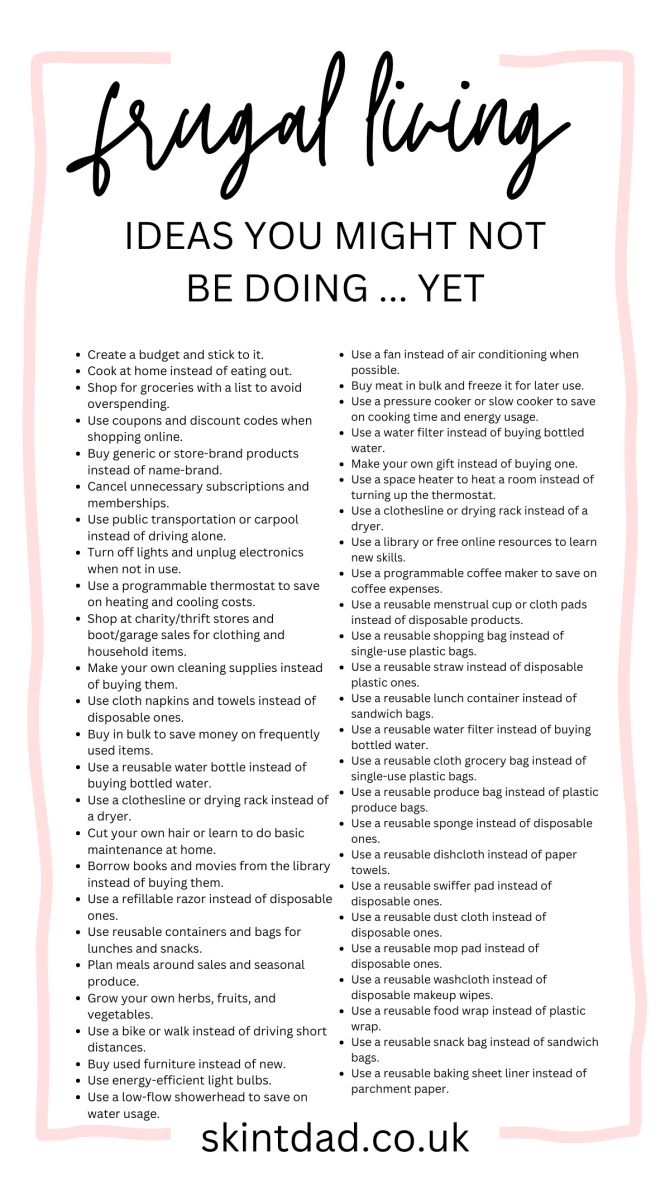

So, hold on to your wallets; here are 30 frugal living tips you might not be doing yet!

What is frugal living?

Contrary to popular belief, frugal living isn’t being financially selfish or tight.

Rather, it is the practice of applying a considered, informed approach to where and how you spend your money in order to maximise its value.

That being said, due to its inherently circumstantial nature, the practice of frugal living is subjective to each and every person, and that is a vital point.

If you want to live frugally, you’ve got to do it your way.

That is to say, it isn’t about cutting all expensive activities such as going on holiday. Instead, it’s about achieving the same level of living in the most economical fashion possible.

For example:

Is it possible to keep your favourite TV package more cheaply with flexible streaming services like NOW instead of subscribing to a contract?

Can you get the same amount of groceries for a lower price from another supermarket or local shop?

Ultimately, you’ve got to find your own path to frugal living.

And, if you do, you’ll soon see that cutting back on spending money and maintaining your current lifestyle aren’t mutually exclusive.

How much can you save with a frugal lifestyle?

The amount of money you can save with a frugal lifestyle depends entirely on what you’re willing to give up and also what you need to live.

For example, an individual who’s living frugally is likely to be able to save more than a family that is living frugally.

However, one thing is for certain; when it’s done well, frugal living can give you greater financial freedom.

As a matter of fact, even if that’s a saving of an extra £50 a month, that saving can reward you in other parts of your life.

30 of the best frugal living tips

Create a budget

Clearly, creating a budget is a must for those who want to save money.

With that in mind, taking an hour or two to sit down, draw up a budget and visibly pinpoint where you can make your savings is a fantastic way to start your path to a more frugal way of life.

So, be ruthless and from groceries to toilet paper, make a note of every aspect of how you spend money and see where you think you could shave off a pound or two.

Once you have, it’s important to stick to your budget.

Don’t get us wrong, it’s fine to treat yourself on occasion (in fact, we actively encourage it) but sticking to your budget as often as possible will maximise its impact on your bank account.

Grow your own produce

In this post-pandemic world, growing your own vegetables has become more commonplace.

If you have the outdoor space to do so, nurturing your own crop of seasonable veg can slice a juicy chunk off your food bills.

Even if you live in a property with no outdoor access, setting up a herb garden on your sun-trap windowsill is not only financially rewarding but can even be therapeutic!

Get a cheap meal recipe book

We’re not going to name names, but in recent years, a whole host of your favourite chefs have jumped on the frugal living bandwagon, producing loads of decent recipe books designed for those who want to live life on a budget.

So, even if you think you have expensive tastes, the odds are, the recipe book to appease your rich palate while saving extra money is out there.

All you have to do is find it.

Bake bread

Just like growing your own veg, making your own bread can prove (anyone?) to be a long-term, money-saving marvel.

Admittedly the initial investment in a bread maker and ingredients will cost a little more money… but it is an investment.

Over time, you’ll find yourself producing many loaves of bread out of bulk-bought ingredients and thus saving more money than you’d normally spend on shop-bought bread.

Worried about the price of ingredients? Why not whip up your own sourdough supply?

All you need to do is take what you need to make a fresh loaf and feed the yeast for it to regrow – there’s only one breadwinner there!

Buy used goods

Today’s society has an unhealthy appetite for ‘new’.

Every year a new phone comes out. Every year a new fashion trend hits the shelves.

However, used and refurbished goods are, more often than not, just as good as their factory-fresh counterparts.

Moreover, the majority of electronics companies offer a “like-new” refurbishing service.

So, the next time you need a new phone or coat, ask to see their refurbished range or pop over to the local charity shop.

You could get a fantastic new item for a fraction of the price.

Sell your clutter

We’ve all got it.

From old electronic devices to material goods that we’ll never use again, selling your clutter is a fantastic way to make a bit of extra cash while also helping someone else buy second-hand.

Happily, from eBay to musicMagpie, there is a wealth of options for those steely souls who can bring themselves to part with their clutter.

So, suck it up and turn your clutter into cash.

Walk or cycle where possible

The health and climactic benefits of walking and cycling are plain to see.

However, cutting back on ever-more expensive public and personal transport systems can be a major way of saving money on fuel.

So, whether you’re going to work or popping to the shops if it’s within walking or cycling distance, it might be time to leave the car keys at home and give up the railcard.

Make your own laundry detergent

Laundry detergent can cost a small fortune, particularly for large households that have multiple washes every week.

With that in mind, one of our simplest frugal tips is to make your own detergent (recipes are available online) or use an Ecoegg.

Do so, and you can instantly slash the cost of clean clothes and make a mean saving on your family’s money.

Hang your washing outside

Perhaps the simplest of our frugal tips is hanging your washing outside.

Yes, tumble driers and radiators are brilliant for drying your clothes in the winter, but they’re also a massive drain on your energy usage.

So, when the weather turns bright and breezy, hang your washing outside if you have the space. You’ll be amazed at the savings you make.

When it comes to winter, or if you have no outdoor space, follow these tips to dry clothes indoors.

Re-dye old jeans

If your old jeans are intact but faded, why waste money on buying a new pair when you can make your old pair as good as new?

Fabric dye is readily available online, so unleash your creative side and give it a go.

After all, what’s the worst that could happen – you were going to chuck them out anyway!

Plan and prep your meals

Yes, yes, this pointer brings back haunting memories of school dinners, but gone are the regimented days of macaroni cheese and sponge cake.

Instead, you’re in charge, and if you plan your own food well, you’ll be able to eat top-quality meals in an economical fashion.

What’s more, by scheduling and preparing your meals, you’re also less inclined to break rank and order a pricey takeaway spur of the moment or pay as you go during your lunch hour at work.

So, plan, prep and save more money.

Invest in a good freezer

The freezer is our frugal friend, and as such, it should be used in tandem with the planning and preparation of your meals.

More specifically, if you plan to cook large batches of freezable meals once or twice a week, soon you’ll accumulate a stockpile of your own cheap meals.

Essentially, just as frugal living aims to stretch your money as far as it can go, investing in a freezer and cooking in bulk enables you to stretch your food as far as it can go.

Think chilli con carne, soups, pasta sauces, even frozen vegetables!

All taste just as good thawed as they do fresh.

Take stock of your pantry before shopping

Food waste is one of the biggest issues facing global society today.

We produce more than enough food to feed the entire world several times over; however, in the UK alone, we waste over 6.5 million tonnes of food every year.

So, check your pantry before drawing up your shopping list.

That way, you can eliminate needlessly buying more of what you already have and needlessly wasting it, to boot.

Saves money, saves food, and, as a bonus – even saves the planet!

Buy in bulk

Bulk-buying is a tried and tested saving tip that many of us have been practising for years.

From groceries to clothing, just about anything and everything is cheaper when you buy it in bulk.

So, if you have the opportunity, bulk brands such as Costco are your frugal-living friend!

Wait for sales

Ask yourself, do you need that thing now, or can it wait?

Sales can be difficult to predict; however, Black Friday and the January sales you can bet on.

So, if it can wait, let it.

That way, you can pick up your new item and make a massive saving.

Haggle your bills

Once you understand that, with regard to your bills, the power is in your hands, it can be a freeing experience.

This is because the onus is on the company to keep your custom. So, as you approach the end of your current contract, give them a call and don’t be afraid to haggle.

It’s the same for insurance and TV subscriptions. Check out Sky deals for existing customers.

If you tell them that you’ve found a cheaper deal elsewhere, then they’ll either have to reduce their prices or lose you to a rival – no prizes for guessing which option they’ll choose.

Just make sure you’re nice about it – aggression gets you nowhere.

Travel in the off-season

Travelling prices can double (and then some) during peak times, so plan your journeys carefully and, yes, frugally.

Whether you’re planning a staycation or a vacation, the off-season is the way to go and could save money that could be injected into your family budget or insurance bills!

Make your own gifts

Making your own gifts is often frowned upon as a cheap way of getting out of spending for birthdays, weddings and more.

However, do it well, and a handmade gift provides more value than an expensive, shop-bought present while helping to save you money; it’s personal, it’s bespoke, and it’s you.

So, if you have the time and talent, don’t be afraid to put yourself to work.

Make your coffee at home

Cafe culture has swept through cosmopolitan society, and as a result, countless chains and indy shops that charge the earth for a simple shot of caffeine have a vice-like grip on our cups.

Swap your shop-bought brew for a cup of your own coffee and you’ll make a daily saving of at least £3. That’s £15+ a week, £60+ a month!

Work out at home

There are literally thousands of free home-based workouts and HIIT routines on YouTube alone.

So, save your pricey gym membership, spend it on a few pieces of equipment, and take your workout to the back room.

More to the point, easier access to a workout = more likely to do it!

Refrain from impulse buying

We’ve all got an impulsive side, but more importantly, we all have a bit of willpower to boot, so don’t be afraid to flex the latter.

If you can curb your late-night spending habits, you could stand to make a saving of hundreds, if not thousands of pounds over time.

So, put the laptop down and step away from the phone – you don’t need those microwavable slippers or the same coat but in yellow.

Avoid late fees

Late fees or hidden charges can be a killer for those who already have to deal with crippling credit card debts and other payments.

So, when organising the repayment of your debts, one of the best things you can do is ensure that you won’t incur any additional fees on top of your pre-determined payments.

If you’re worried about late and hidden fees, speak to a financial advisor.

In the long run, it could save you hundreds of pounds.

Automate your finances

Once you’ve thrashed out a budget, it’s a good idea to automate your finances in order to avoid lapsing into old habits.

You can do this in several ways, but arranging direct debit for your household bills and automating your day-to-day and retirement savings with your employer is a solid place to start.

You could even look to automate your savings and see them add up for a rainy day or a special occasion.

Use your local library

Libraries still exist!?

Yes, they certainly do, and what’s more, they’ve moved with the times more than you might think.

With tonnes of books, films, magazines, music and more available to those who sign up for a library card, using your nearest library could save you a small fortune on home entertainment.

They might even have their own section on money-saving tips!

Check in on your subscriptions

Another easy way to save money is to check out your subscriptions.

So, ask yourself: do you really need that Amazon Prime subscription? How often do you listen to Spotify? And, now that you have a job, is LinkedIn Premium worth the outlay?

Cancelling redundant subscriptions can be a fast-track way to spend a lot less money – so keep a keen eye out for self-renewing subscriptions!

Consider a part-time job

Most of us are rushed off our feet due to our 9-5, but if you can muster the time and energy, picking up a part-time job can be a fun way to put away a few extra pounds and make a big difference to your frugal living journey.

Also, with a wealth of genuine work from home job opportunities available, if you want to earn money from the comfort of your sofa it’s totally possible.

It’s more achievable than you might think to find high paying remote jobs (which save you on commuting costs).

Prioritise clearing debts

It goes without saying that paying off your debts can represent a substantial outlay.

However, due to paying interest rates and long-term repayment plans, not paying them can be an even greater hindrance to those who want to save money.

With that in mind, where possible, we’d recommend prioritising clearing arrears such as credit card debt. Try to view it as the start of living a frugal lifestyle.

Once you’re paid up, the monthly payments you once had are immediately freed up for savings or redistribution elsewhere in your life.

Improve home insulation

Energy prices are going through the roof, and aside from the climactic benefits of home insulation, where possible, it’s also a fantastic way to save money on energy bills.

It’s simple enough. By improving your home’s ability to retain heat with cavity wall and loft insulation, and double or triple glazing etc, you’ll need less energy, and therefore money, to heat and retain heat in your house.

Consider downsizing your home

Kids moved out?

Spending a fortune heating three bedrooms when you only need one?

Downsizing can not only provide a significant cash injection from the sale of your larger home but also save a fortune on the cost of living.

It may be a bind to leave your home behind, but it can also represent a significant investment in the future benefits of frugal living.

Decide what you can live without

The last of our frugal living tips brings us full circle back to the first.

When you create your frugal living budget, don’t be afraid to be ruthless.

Taking such an approach will immediately highlight what you truly need and what, quite frankly, you could live without.

For example, how often do you watch sports channels? Do you need to hire that gardener? Do you need three cars?

Being ruthless can be a cathartic experience and will instantly reveal where you can save on your monthly bills and outgoings.

All you have to do is be honest with yourself.

FAQs

No, being frugal isn’t about living as cheaply as possible; it’s about living more economically within your means.

It’s about spending your money better rather than not spending it at all.

As such, even extreme frugal living doesn’t necessarily require you to sacrifice in order to accrue cheaper expenses. Instead, it simply means retaining them in a more cost-effective manner.

You can save money on your bills in loads of ways.

For example, renegotiating your bills and subscription services, such as television packages, can be a brilliant way to cut costs.

Furthermore, implementing processes such as insulating your house, drying your washing outside or downsizing your house can also substantially reduce your monthly outlays.

For us, the number one frugal living tip is to budget.

Once you have established precisely what you need and what you can live without, all the other tips we’ve recommended can fall into place.

For example, once you’ve set a TV, energy, transport and food budget, you can instantly start to curb their expense.

A frugal budget is the gateway to a frugal life. If you can budget well, then you’ll save so much money just by adhering to it.

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- Side hustles and benefits in the UK: what you need to know - 8 January 2026

- Lloyds Bank switch deal: grab £250 plus Disney Plus for free - 6 January 2026

- Thinking of doing the Co-op freezer deal? Read this first - 6 January 2026

Imran h r degmaster says

I’m looking to move into my own home I need help with white goods . A grant or if I can personally go and collect and get these items delivered to my new address.

I’ve read but no where it states HOW?

Naomi Willis says

Check Turn2us for a grant and you can apply through them.

thara says

Find cheaper childcare. Ask around or try your luck on the Internet, there are dedicated websites that are basically a online childcare directory. They are worth a look in any case. Or you can try to quietly find out if there are any before or after school clubs or activities in your local area for bored children.

That is another good option too. Often times the schools will run many extra curricular clubs and activities for school age kiddos of all ages so that parents can work. I’d start there and take it from there really when making inquiries. Do your research properly. See if your family and friends can help out.

Kayleigh Dunne says

i love your definition of frugal at the end.

Thara says

Sorry I was not sure if you were talking to me or not.

Here are more useful tips. Find out about current deals online. Make brief summary notes on deals and discounts on offer. Good luck. Read past the lines. Get your books from a library instead of buying at a bookshop or from the internet. Rather than rely on a big shot supermarket choose to do a weekly food shop at a farm shop or produce market. Alternatively you can do a top up shop at a quiet time of the day in order to save more money.

Other popular options include food delivery boxes and asking friends and family members to buy stuff for you. Another option is to learn some basic culinary skills at a cookery class or at home. This is to cut down on the spending costs overall. For example you can even use free cookbooks to make up a batch of cheap lunches and teas to have. You can cook stuff if you put your mind to it. Go for it. You have nothing to lose.

Thara says

Heya.

This is a list of ways to do exercise. Go to exercise in a park in order to have access to the fresh air and sunshine on a very hot day. Ride your bike along the paths in a park or take a free nature walk. Alternatively see if you can afford activity classes at your local leisure centre in question here. Ring up to find out more about class options or email. Best wishes to you. Exercise can and should be fun.

Or you can attend weekly exercise classes with a friend or family member too. Put on your own music and then go and dance around the living room. Hold your own parties. Get some more recommendations in case. You can buy a new exercise ball on the cheap via Amazon these days. You can even purchase a exercise DVD and mat for a very decent price. You can also use the garden to do beneficial exercise as well. For example try weeding or watering the plants outside. Animals serve as a means of getting some more helpful exercise.

Some people have fun exercise equipment to hand in addition. There are literally hundreds of tried and tested methods of exercise freely available. All you need to do is to pick the ones that will work for you and forget about the rest. If the council run gym is off the list of viable options, look at the other solutions. A hula hoop can be used to your full advantage instead. Purchase a cheap one. Seek out ideas as much as possible. Consider all options.