Are we no longer bargain hunters? What’s the trend behind searching for expensive things, and why are costs rising everywhere?

£10 sign up bonus: Earn easy cash by watching videos, playing games, and entering surveys.

Get a £10 sign up bonus when you join today.

Join Swagbucks here >>

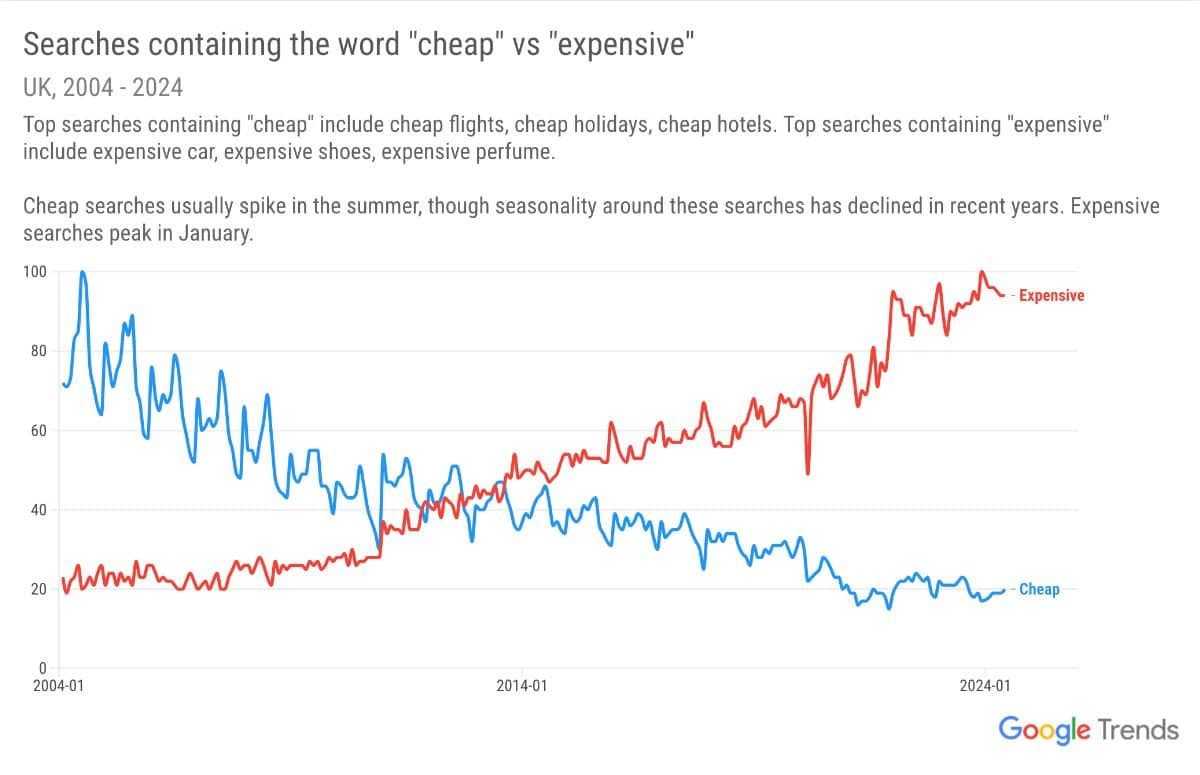

Data has shown that fewer people are searching for cheap deals. Have we stopped being a nation of bargain hunters? Or maybe we’ve already mastered the art of saving, knowing how to find deals whenever we need them, all while living our best frugal lives?

Over the last 10 years, Google Trends has found that more people are searching for “expensive”. Is it because we’ve suddenly got more money to burn on cars, clothes, and cruises? Nah!

I reckon it’s because everything is so blooming expensive now that just living and breathing feels like a luxury (at least they’re not taxing air like in the Lorax…yet!).

Why is everything SO expensive?

Does popping to the shop for some milk and bread feel like you’ve been mugged? Prices are skyrocketing, and no, it’s not just your imagination. Every time you blink, it seems like the cost of your favourite chocolate bar has jumped up by 20p. So, what’s going on?

That’s why I think people are searching “expensive” as we purely cannot get our heads around why is car insurance or home insurance or olive oil so [expletive] expensive?!

Turns out, there are a bunch of reasons why everything feels like it’s costing an arm and a leg. From global events to supply chain issues, it’s all making our wallets are feeling lighter.

The impacts on our daily lives

- Car insurance: Car insurance premiums have jumped by 34% in the last year. With more people returning to the roads post-lockdown, the number of claims has increased, driving up costs. Insurers are also facing higher repair costs due to shortages of car parts and materials. Although, the ABI has said that paid claims are only up 8%, so why the need for a 34% increase?

- Food prices: Every trip to the supermarket feels like you’re being robbed. How is a box of cereal now a luxury item? Food prices have risen, with essentials like olive oil up 136%, sugar up 72%, and 2.5kg bag of spuds up from £1.85 to £2.20. Supply chain disruptions and increased production costs are the main culprits.

- House prices: Buying a house now feels like trying to catch a unicorn. The average house price in the UK has risen by 8.7% over the past year, reaching £281,000 (Reuters). Low interest rates and high demand have created a seller’s market, making it tough for buyers to find affordable homes.

- Energy bills: They may have come down in the last energy price cap, but it’s predicted they’ll go back up again by a few hundred quid by the end of the year (you know, just in time for the weather to be freezing and we’ll actually need to use it).

- And everything else!

While we can’t control global pandemics, supply chains, or inflation, we can make smarter choices to stretch our pennies further. Next time you’re grumbling about the price of a coffee, at least you know who to blame – and it’s not just your local barista.

- Bank switch offers October 2024 – get up to £200 for free to change accounts - 2 October 2024

- Farmfoods offers, vouchers and latest deals this week - 2 October 2024

- Tesco clothing sale 2024 – 25% off F&F sale dates - 26 September 2024

Leave a Reply