Many people started the 1p saving challenge at the beginning of the year but a few of you have started to struggle. Don’t get put off – here are some tips to keep you on track so you can still save £667.95 by the end of the year.

£10 sign up bonus: Earn easy cash by watching videos, playing games, and entering surveys.

Get a £10 sign up bonus when you join today.

Join Swagbucks here >>

Many people started the 1p saving challenge at the start of the year. They will be well on their way to saving over £650 by the end of December which is a nice sum of money!

As a quick recap, if you’re not sure what the 1p savings challenge here is a quick summary for you:

1p saving challenge

- On day 1 save 1p

- On day 2 save 2p

- On day 3 save 3p

- And so on until you get to the end of the year and you would have saved £667.95 in a normal year (£671.61 in a leap year!)

Saving in this way is a very easy way to save over £650 in a year. You don’t have to start it at the beginning of the year, in fact, many people are planning to start it later in the year so they don’t have the highest saving days coming up to Christmas.

We always start the 1p Saving Challenge in November, which means we save less in December (when we usually spend more), and have finished our savings to spend at the end of the year.

If you have started and are struggling to keep remember to save, or you worry that you’ll start the saving challenge but will drift in and out, check out these tips. They should help you save successfully for the whole year – case who wouldn’t want an extra 650 quid?!

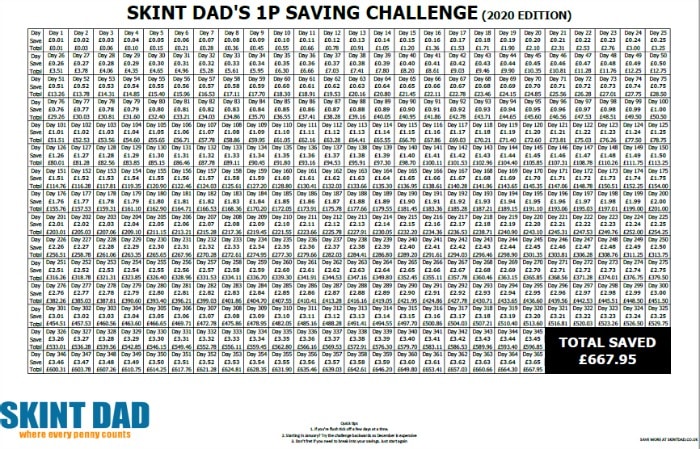

1. Download the 1p savings chart

First up, you need to make sure you get the 1p saving chart downloaded.

You can either choose a PDF or Excel chart, depending on whether you want to print it out and have it to hand, or you prefer keeping a copy of your computer and marking it off then saving it.

Starting the challenge is easy enough as you remember that day 27 means you need to save 27p but after a few months, it’s so easy to forget how much to save next.

With the free printable chart, you can just tick off the amounts day to day to keep you on track.

2. Set a reminder

Whether you set a daily alarm on your phone, add a calendar reminder in your Google Mail or whatever service you use or even try a bit of string around your finger, having that reminder will mean you can’t forget to save.

No more having to make up three or four forgotten days as realistically, if you miss too many, you may lose momentum and give up!

3. Create a routine

I have a set routine every day. I wake up, check my phone, get up, put the kettle on, open the blinds in the kitchen, and make tea. It’s the same every day. This routine makes sure that I at least make tea (not that I always manage to drink it hot!)

If you need to remember to do something every day like this saving challenge then create a routine and a schedule that you can follow. Doing the same things, in the same order will soon become a habit.

Maybe the morning is too much of a rush for you but you have more time in the evenings to count pennies into a jar? You just need to fit it in around you and what works for you.

4. Save as you can

While saving a few pennies at a time sounds easy, when you get to the larger amounts it can get harder.

If you’re a bit flush and have a load of spare change then tick off a few of the bigger days.

So, although it may only be day 24 for you if you’ve got £2.69 in your pocket then tick off day 269.

We regularly do this and save up a load of change, then look to tick off a week at a time.

5. Save with a buddy

Sometimes going it alone can become a bore so why not try to get a mate involved and you both save together. Maybe you’d have a similar goal at the end of it (weekend away, shopping trip…?)

If you have someone to share the challenge with, it will spur you on to save. A bit of competition is healthy and it your friend can be that extra reminder to save every day.

Come on, you must have a mate who’d love to save an extra £650 with this year? Who would you pick?

If you need support, come and join the Facebook Community Group where we give each other encouragement to save.

6. Ask for change

Saving a few pennies a day is easy as most people have loose change about the house but if you usually pay by debit card when shopping you’re probably not going to have much cash in your purse or pocket.

It’s a good idea to buy with cash every now (don’t buy something every day or you’ll end up spending more money!) and then and ask for change which you can put towards your daily savings limits.

7. Start whenever you want

Many, many people start the 1p saving challenge in January. New year, new you and all that!

However, that doesn’t mean you need to save along with them.

If March is a better time of year then start then. If 23rd October works for you then start on that day.

8. Don’t give up

I’ve spoken to a few of you who start the Skint Dad 1p saving challenge then have to raid it half way through the year.

One person, in particular, was devastated! But, I saw it as a great thing!

She needed to raid her 1p savings as the car had unexpected MOT repairs and she needed new tyres. She had no other savings to pay for the work needed.

I suggested that if she hadn’t started saving her pennies in the first place, there was no way she’d ever afford the repairs, without turning to credit.

While she had to stop part way, she had made a huge achievement! She had emergency savings and was able to use them for something worthwhile.

And you know what, the following week, she started the challenge again.

If you stated the 1p saving challenge it means you’ve got some extra money saved for an unexpected event. Yes, it’s nice to plan to spend it at Christmas, or for a birthday treat, but if you need to use it for something else then it’s fantastic you’ve got some savings there.

Don’t worry if you have to stop or you need to dip into your savings. Just start again, and be thankful you had some savings there :)

9. Do it backwards

Going forward is not always the right way.

Yes, it’s really easy at the start, but you can start to get put off when the amounts get higher.

Instead, look to start at day 365, and work backwards to day one so the challenge gets easier as you go.

And, when you’ve finished the challenge, whichever way you’ve done it, here is where to find free coin counting machines so you can switch it all over to notes.

Still struggling with the 1p saving challenge?

If you are really not getting anywhere with the 1p saving challenge you can still save.

Having the money laying around the house in a savings jar can prove too much of a temptation to spend it. Instead, find a way to save money more securely. Buy a sealed tin that you’d actually have to crack open, rather than saving the money in an open bowl.

Is you could get the money into a bank account on a weekly or monthly basis, you’d be certain that the cash couldn’t be spent so easily. Plus if it’s in the bank, you’ll start earning a little bit of interest on it – even if it’s only going to be peanuts!

Why not try automating your savings with this nifty app? You won’t even notice that you’re saving money and you don’t miss it.

Instead of getting cash out of your bank, transfer money straight from your current account into a savings account. Naomi is transferring £12.50 each week in this way instead of doing the challenge. She will still have £650 at the end of the savings year but without having to count out pennies.

Or why not try a different savings challenge instead.

Have you started the 1p saving challenge yet?

- Where can I use my Blue Light Card? Discounts list 2025 - 1 January 2025

- Best paid surveys to earn money online in 2025 - 1 January 2025

- £18 million in Tesco Clubcard vouchers about to expire – use them or lose them! - 12 November 2024

Laura Wilson says

Brilliant idea!! Thanks for sharing :)

Ricky Willis says

No worries Laura. Are you doing the challenge this year?

Ricky Willis says

Sounds like a good plan – it soon adds up!

Ricky Willis says

Hi Karen. Glad it’s been useful. I certainly will make a new 1p challenge for 2017

disqus_YRFEJ58JTE says

I just counted mine up, £677.70, 10 swiss cents and a 2 euro cent. Have it all to take to a bank and get it paid in, or maybe I’ll just keep it under the bed, just need to make sure all those £1 and £2 coins are changed before October. Started again this year too.

andydgg says

I just wrote on a piece of A4 paper the dates and added 1 to each day then crossed each day off as I put money in the tin, I knew I was over when I passed 365 in mid December lol. I’ll just hand the bags into my bank, or maybe just keep it. Yes I’ve started again, it’s a good way to put something aside.

Ricky Willis says

Wonderful savings there! And glad to hear you’re starting it again. I think most banks usually will only take a few bags of change at a time so plan your trips carefully.

Nerissa Macfarlane says

I tried doing the penny a day challenge last year but when my daughter broke up with her fiance and moved back home in August I had to use it to buy her a bed, but if I hadn’t done the challenge I wouldn’t have been able to afford one straight away, I’ve started it again this year using a little diary that tells me what day of the year it is and how many left till the end of the year and depending how much change I have in my purse mark of the corresponding day so now have just over £500 saved and looking forward to being able to treat my husband on our 5th wedding anniversary in March.