Which of these 5 practical and easy lifestyle changes will you make to save up to £500 each and every month?

£10 sign up bonus: Earn easy cash by watching videos, playing games, and entering surveys.

Get a £10 sign up bonus when you join today.

Join Swagbucks here >>

Having an extra £100 would be lovely, thank you very much, so wouldn’t it be great to make that saving this month?

But, what if you could save a £100 each and every single month?

The extra cash in your pocket, I’m sure, would make a real difference and you don’t need to make massive changes to see it.

Just a few small lifestyle changes are all you need to keep more money in your bank every single month.

Don’t just make changes

Whoa!!

Slow down!!

Saving £100 is a big deal so you may want to run off and start doing it all now – but STOP!

You need to work out why you’re going to make a lifestyle change in the first place before you do anything.

Set a savings target

Before you start to change your lifestyle you need to have something to aim for.

Set a goal so you have something in mind to push your savings for. The reason is that if you are just cutting money out for no reason, you’ll quickly get bored.

That boredom will start to make you question why you’re doing it in the first place. You may lose momentum and just give up.

Instead, set yourself a target.

Do you want to save up for something special? A trip with the kids? Or maybe you want to clear debt a bit quicker, or save towards a holiday?

Whatever spurs you on, write it down. Stick it up somewhere you’ll see it every day. Pop a post-it note on your bathroom mirror, stick one inside the fridge, put one next to the kettle, in your car, at your desk at work – basically anywhere and everywhere.

This will give you the motivation and reminder that your change in lifestyle is being done for a reason. If you think you’ll cave in, a written down reminder of what you’re saving for will spur you on to succeed and not give in.

Plus, if other people see it, it will give you some accountability that you need to stick to your target.

So, how about making those lifestyle changes and save yourself £100 a month? Why not do all 5 and save yourself up to £500 a month!!

1. Stop with the top ups

How many times do you go to the shop a week?

Most people will do one big shop, then head back to do one, even two, or three “small” tops ups a week.

Your master plan may be for your top up to grab fresh foods like milk and bread, but it’s these shops when things, unfortunately, start to slip.

After a busy day at work, popping to the shop to grab a loaf of bread can easily turn into a £10…£20…£30 spend…now that’s a lot of bread!

It’s easy to pick up a basket out of habit, pop in some yellow sticker bargains, a bar of chocolate and a bottle of wine (it was a very hard day after all!). However, doing this a few times a week can add up to hundreds of extra on your food shop over the course of a month.

If you’re already meal planning you may need to tighten your process (if you are not, you MUST start – you’ll save a fortune!)

Are you able to buy extra in your main shop and freeze it (both bread and milk freeze well)? If you don’t have space, then change up what you do.

Firstly, avoid the big supermarkets, especially Aldi or Lidl where their middle aisle might get you tempted to walk out with total bargains including a trumpet, 2-person tent, a ratchet set and a colouring book, but you’ll forget the bread!

Instead, head to a corner shop. While you may think they are more expensive (and they can be) if you’re spending more than you should on random stuff when you top up, you will make a saving cause you’ll only buy the little bits you need.

A couple of other options are only having cash with you, so you’ve got no option to buy any extra (maybe time to deactivate Apple pay?), or give your kids the money and send them in with a list. They’ll love the responsibility and won’t likely walk out of the shop with more than you asked for.

2. Nothing beats retail therapy

Even if it’s just window shopping, we are a nation that like to unwind by hitting the shops.

Trouble is, the high street can be so blooming expensive.

Window shopping is ok on your bank balance, but if you really need to shop then stick with second hand.

Whether it’s a charity shop on the high street for clothes, a charity warehouse for furniture, a carbooty, using eBay, Facebook Marketplace, Gumtree or Freecycle you can get all other sorts of things for much cheaper than brand new.

We’ve picked up all sorts of wonders second hand including gorgeous newborn clothes bundles for the kids, furniture and toys. You really wouldn’t guess they weren’t brand new.

As an added bonus on saving money vs buying new, you’ll be doing your bit for the environment. Instead of unwanted items heading to the rubbish dump, you’ll be giving them a new home and a new lease of life.

3. Cut down your caffeine kick

Are you the kind of person who needs that buzz of coffee in the morning to get you started?

Maybe you need two hits of caffeine?

In no way am I going to say cut it out altogether – as I love coffee myself – but you can save around £100 a month if you ditch your fancy coffee shop brew.

Invest in a travel mug and make your own coffee before you set out.

Read this: Ideas and Hacks to Save Money at Starbucks

£100 may seem like a lot to spend on coffee, but if you keep a spending diary, or look back at how much you buy, the costs soon add up! A coffee a day (maybe two), plus something at the weekend while shopping, will set you back a wad of cash.

You don’t even need to opt for instant. You can get a machine to brew fresh coffee for a good price and it works out much cheaper in the long run.

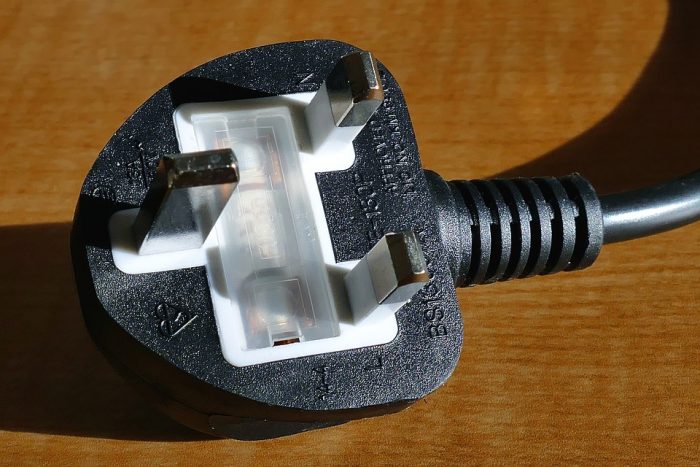

4. Adapt how you use utilities

Now, this isn’t about cutting back on your spending habits, but all about changing your living habits (and the habits of your family) around the home.

A few very small (and I mean really small!) changes can really add up to a lot.

With the cost of gas, electric and water being so high, anything you can do to shrink the cost would be great, and you can really save £100 a month if you do.

Now, I said small changes and they really are. It may seem pointless, but these ideas will truly cut your bills down.

Here goes….switch off lights when you’re not in a room, turn ALL plugs off when you’re not using the item (including phone chargers, the microwave, kettle and TV), draft proof, only fill the kettle with the water you’ll use, use a bowl to wash up instead of letting the water run.

Very small changes like this add up fast!

To make even more savings (around £300 a year) look to switch energy providers too!

Read more: save money on energy bills without switching

5. Ditch the meal deals

You may “think” you’re getting a deal, but in all honesty, when you buy a “meal deal” you’re paying over the odds for a few bits of bread, some crisps and a drink that you can get a WHOLE lot cheaper if you did it yourself.

In a rush and don’t think you’ve got the time?

It really doesn’t need to take a lot of time to prepare lunch for work, especially if you keep to the same kind of meal deal foods.

When heading to do your food shop, grab a multi-size bag of crisps – immediate saving right there. A multi-pack of drinks (or just stick to water for an even bigger saving).

£100 easily adds up over the course of a month when you’re eating out each day. It won’t necessarily cost you that much more at the supermarket either.

If you’re worried about forgetting it at home, take all your bulk buy bargains into work and store them there.

Whether you choose to change your lifestyle habits and save some money, be it £100 or go all in and save £500 a month, be sure to set yourself a savings target to keep you motivated.

Leave a Reply