Don’t get caught out by financial fraud scams. Whether over the phone, by text or by email, look at some of the tell-tale signs of fraud so you know what to look out for and keep yourself safe.

If you think everyone in the world has a heart of gold, I’ve got some bad news for you.

I’m sorry to say that there are some horrible people out there who want to take you for every penny you have.

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

When you’re skint it may not be hundreds of thousands of pounds, but even losing a hundred quid when you’re struggling to make it to pay day would cripple a lot of families.

These criminals don’t know who you are – it’s not personal.

They are just waiting for the moment they can syphon your details for a quick fix, leaving you broken. They’ll be happy as they’ve hit their goal and can steal your money.

They want to get access to our personal sensitive information and then go on to use it to defraud us!

However, let’s not even get to that point – let’s look at the ways you can spot a scam, so you can protect yourself and prevent future fraud!

Take Five to Stop Fraud

Financial Fraud Action UK have launched the Take Five campaign to help us spot a scam when it’s about to hit.

Their Scam Academy take us back to school and show us the little things to look out for to make sure we keep safe and secure.

There are three modules that make up their academy:

Module 1: Email Scam

Hundreds of thousands of people have received an email scam – myself included! Some of them are very easy to spot, but others are starting to get a little harder as the crooks are becoming smarter.

I get so many emails every day! (Sorry if you’ve emailed and I haven’t replied, I will get back to you as soon as I can, promise…!)

While I do tackle each one at a time, my mailbox is also prone to getting emails where I need to question them.

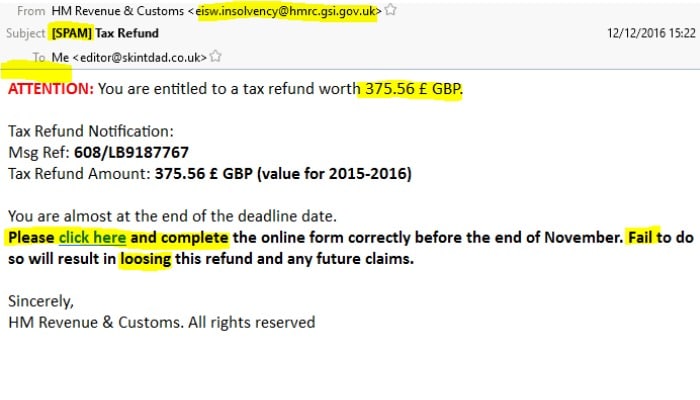

Here is an email I got just the other day. On first sight, I panicked! I didn’t read it properly as I thought I was in trouble, and very nearly clicked the link. It was only as my mind started to catch up that I realised something was not quite right.

I’ve highlighted some of the issues you need to look out for:

Starting from the top….

- It comes from HM Revenue and Customs, but the email address doesn’t match

- One tell-tale sign is that my mail box saw this as spam (thank you!), however other mail providers don’t always catch it

- Scam emails usually say “Dear Sir”, “To Customer” but this once doesn’t have any kind of introduction. Emails sent to you will call you Mr/Ms [surname] – they will be personalised.

- The monetary amount – that’s not a normal way to write in money in English

- If you hover over the “click here”, the address shows something like as http://www785 452.fghjk.nz/php (this is not a real website, just an example). Surely you would expect to go to a gov.uk site for this kind of email?

- Then, my favourites are the typos. “Fail” should be failure and “loosing” should be spelt losing.

Module 2: Number Spoofing

Text messages: I get them from my wife, my daughter, and I also get them from fraudsters!

Now for these, I actually just delete them straight from my mailbox, so I don’t have a screen grab example to show you.

I can get a little confused when it comes to text messages from my bank. When I try to make a payment but my bank has declined it for whatever reason, I get a text message from them.

Because I am cautious, I don’t at first know whether to trust it. However, the real text messages from the bank will just ask for a “yes” or “no”.

Your bank doesn’t want you to click a link or give out any bank card details or personal information. It’s just confirming a yes or no. They may ask you to call their fraud department, and you can find the number of the back of your bank card.

Other text messages from fraudsters will try to get you to do something else.

Please do look at this video to get know all the tips you need to spot a scammer who is just out to get your money.

Module 3: Phone Scam

If you get a call out of the blue, how do you really know who it is?

We have a landline (although only have it for our broadband) and rarely use it and never get a call. When a call comes through we look at each other like there is a strange noise in the house! Where is that ringing coming from?

Once we’re over the shock, we find that we’re speaking to Company X (who call themselves a real brand name), and want to tell us about the risks we have of using the internet. The very lovely person goes on to tell us that we don’t have enough internet security (not sure how they know what package we have?) and that we need to buy one from them immediately and it’ll fix it.

If I could just give them the long card number across the front… and I hang up.

They are not from the company they say. They don’t know what I’ve bought or haven’t bought.

And even if they have for some strange reason, it is easy enough to say I’ll call you back with a number you can find directly on their website – don’t EVER call a number they try to give you as it could be part of the scam.

If it’s a genuine caller, they won’t be upset or angry that you don’t trust them. They would be happy for you to make your own call to check.

When it all comes down to it, the best thing you can do is be wary of everyone. Whether by email, text message or phone call, if you think there could be ANY possibility that it is genuine then contact the company directly.

Take Five fraud quiz

How do you think you get on when it comes to financial fraud? Why not have a go at their interactive quiz to see how well you handle scams.

You may know some of these tips, so are keeping yourself safe already, but hundreds of thousands of people are unfortunately falling victim to these methods of crime.

If you’re savvy when it comes to this, please do share with your friends and family so, as a nation, we can fight back and keep our money in our pockets.

Written in collaboration with Financial Fraud Action UK

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- Side hustles and benefits in the UK: what you need to know - 8 January 2026

- Lloyds Bank switch deal: grab £250 plus Disney Plus for free - 6 January 2026

- Thinking of doing the Co-op freezer deal? Read this first - 6 January 2026

Tiffany Griffin says

I almost fell for an email scam, and I consider myself “in the know” when it comes to this type of thing. It was a fake PayPal email that showed a receipt for a large purchase I didn’t make. I immediately started to panic, and almost clicked through, but thankfully, it hit me that the email could be a fake. Goes to show how easily you could be a victim of these types of scams.

Ricky Willis says

Totally agree with you. It’s that split second of worry that takes over all logical sense in our heads.

There seem to be more and more of them as well. Just this morning I had one about a TV Licence refund – looked so real, but there were still the signs if you looked deeper (bad typos, not from the TV licence email address etc).

I’m glad you spotted it in time.