Could a no credit check, no interest, no fee, buy now pay later supermarket be a lifesaver, or is it not all it’s cracked up to be?

Buy now pay later sounds like a good idea from the outset.

You may not have any money saved and, say, your TV is up the spout. A shop offers you to take the TV home, and you can pay it off over X months.

Get a free £10 bonus with Swagbucks

Earn a bit of extra money in your spare time with surveys, videos, and simple tasks you can do at home.

New users can get a £10 bonus when they sign up.

Get the £10 bonus

Trouble is you’ve got a lot of interest added on and that TV will cost you a lot more than was on the price tag.

But, if you’ve not been saving (or you needed to use your savings elsewhere), then you may feel that paying later is your only option.

Essentially, it’s just another form of credit. Whether you think of a loan, credit card, or overdraft, it’s exactly the same.

You use the money to buy something and pay it back over time.

Buy now pay later

You may have seen a new way to pay with certain retailers using something called Klarna.

This is a way to buy now and pay later, but it can be dangerous. With the fancy branding behind Klarna, millennials are more tempted to impulse spend, with no money in the bank and may soon get trapped in new debt.

But it’s usually for throwaway stuff. Most people don’t usually need more clothes or things for the home – it’s a want.

Because you’re not spending cold hard cash from your bank, you may not feel guilt or regret of making the purchase.

Now there is a buy now pay later supermarket.

I think what may be different with this is that we need food to survive.

Being hungry is the pits!

And, while many don’t care about getting new clothes every week, they definitely need food.

Buy now pay later for food

I’ve done a bit of delving into the buy now pay later supermarket Flavva to see if it’s cracked up to be as good as it claims.

You may think it’s a lifesaver if you’ve got no cash and you’ll get some food in the cupboards fast, but it’s not quite like that.

How does it work?

You can sign up for a free account and get a £40 credit limit to spend straight away.

There are no credit checks, and nothing will show on your credit file, which sounds like a dream if you’ve got money issues in the first place.

You then fill up your online basket with any groceries you want, browsing around the categories to see if you need anything to your store cupboard or even something for your pet.

Then head to the checkout.

What else should I know?

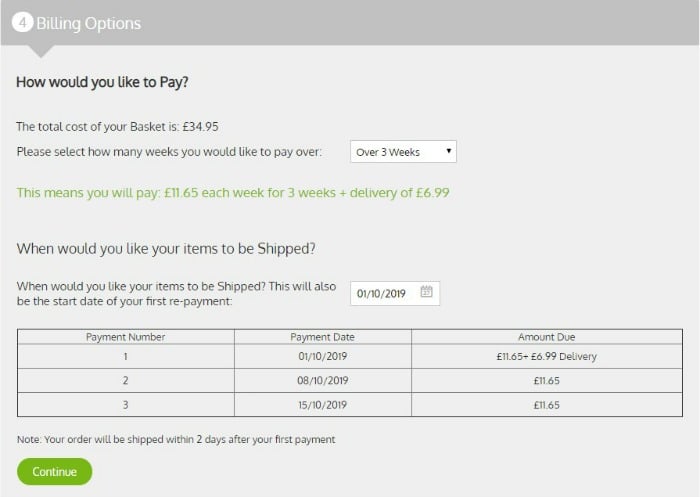

You must spend a minimum of £30 (with a top credit limit of £40).

This may mean you add a load of stuff to your basket that you don’t want.

Also, there is a standard delivery charge for all orders, which is £6.99. This must be paid alongside your first payment.

Slightly worryingly, they say on the site that if there’s any damage to your order, then you need to claim to the mail service.

My understanding of the Consumer Rights Act (which is echoed by consumer champion sites Which?, Resolver, Citizens Advice – I don’t think you need any more examples!) is that your contract is with the retailer, so it’s them who should be dealing with any issues with your items.

Don’t go to the courier; they will just refer you back to Flavva.

Next, it’s not really buy now and pay later because you have to pay before you get your food.

At first, I wondered whether this would give people a lifeline when they really needed food, but you’ve got to pay a minimum of 1/4 of the bill (plus delivery) before they ship your food out.

You then need to pay the remainder of your balance on weeks two, three and four, or whatever payment option you choose.

Should you use it?

I would say that it could be an interesting service, but (big BUT)…

Hear out what you should look at before using a “buy now pay later” supermarket.

Costly

Flavva tells you:

“Get your shopping direct to your door, without the huge costs of a traditional shopping supermarket”

Not entirely….it is an expensive option.

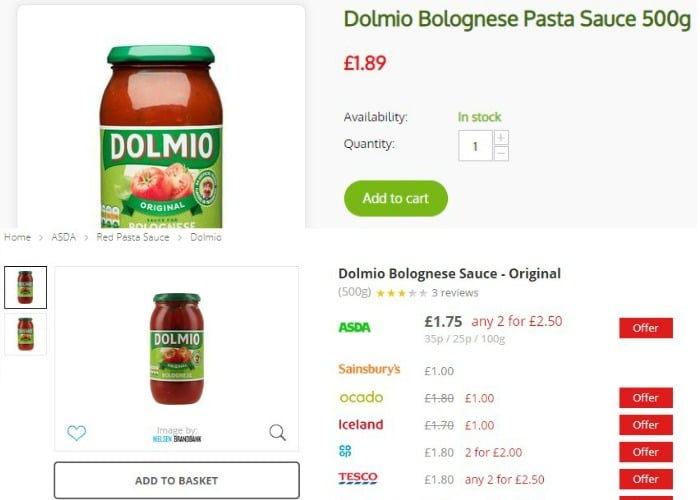

The things for sale cost more than you can get at mainstream supermarkets.

This is just one example:

Everything is branded and has a premium added.

You can get a supermarket own brand for even less.

But you obviously need the cash upfront if you shop at a supermarket.

Although there are occasional mega discounts.

But, many of the things shown on the home page that look really cheap aren’t available to everyone.

Getting crisps at 1p a pack, while not healthy, are still a snack and a bargain. And a great price on the pineapple.

However, they are not available in the store to buy unless you pay extra to be a Benefits member (see below).

You sign up thinking you’ll get one of the products on offer and they don’t exist for a free membership.

No fees

While it costs more, there are no credit checks which may be a relief if you’ve got bad debt.

They don’t charge fees, and there is 0% APR interest on what you buy.

The site also says that there are no late fees paid.

Now, if you have a change in circumstances and cannot afford to pay it back, you need to tell them, and they can arrange for you to pay it back a bit later.

Read: Buy Now Pay Later products will start appearing on your credit report

However, if you continue not to pay it back, there will likely be late fees or management fees added as they try and chase the outstanding debt.

There is the paid membership level, but it could be cheaper to have an Amazon Prime account, get free TV/films and get food delivered too. (See Amazon Prime Review: Is It Worth The Money?)

One thing also worth mentioning is that there does appear to be fees.

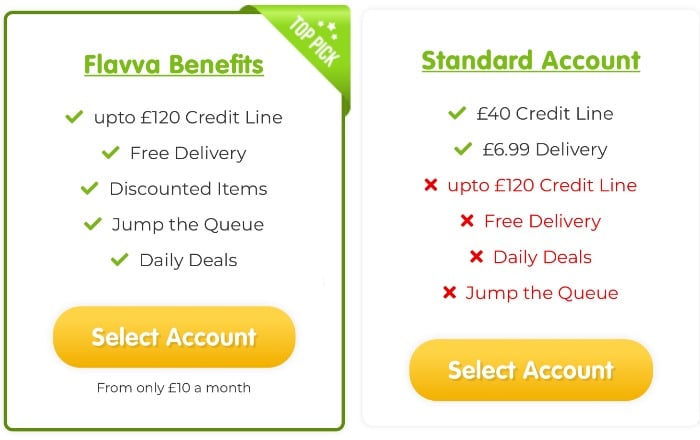

What you don’t see from the outset is that there are two membership levels, and one of them is paid.

- The “Top Pick” account allows you to have a credit limit of up to £120. You get free delivery, discounted items and daily deals – but it will cost you from £10 a month.

- Alternatively, you can pay nothing to have a “Standard Account”, get £40 credit to spend, but have to pay £6.99 to get your groceries delivered.

I suppose if you’re going to order at least twice a month, taking a paid membership will save you money versus paying for postage two times.

It’s not going to feed you

The food available is more like cupboard staples.

Baked beans, super noodles, cereal and sweets and biscuits – it’s not going to feed you well for very long.

You cannot buy any fresh foods.

Yes, buying this like this can be useful to stock up, but why not just do it from a standard supermarket?

Grab a few tins when you do your usual shop, or get a bargain from somewhere like Approved Food as it will soon add extra to your pantry.

Buying packs of Pringles for £2.49 each time, or pasta for £1 a pack, plus having to pay for delivery, is not a good deal as you can get them elsewhere.

I think they are pushing the idea that you don’t need to pay for your shopping upfront and can be flexible with your payments.

But that’s not really how it works – you need to pay for part of your shopping before they deliver it.

You will still need money on the other weeks to pay off the rest of the shop.

Instead, the day you get paid, you could do an online shop with Tesco. Their minimum delivery is usually £40, but you can order less and pay a £4 charge (plus delivery).

Or use Iceland, and you’d need to spend a minimum of £25 to have it delivered from store, or £35 for free delivery when you shop online.

Yes, you will need to pay for all of it, instead of spreading the cost, so why not try to go to Aldi or Lidl instead and get it even cheaper?

Flavva reviews

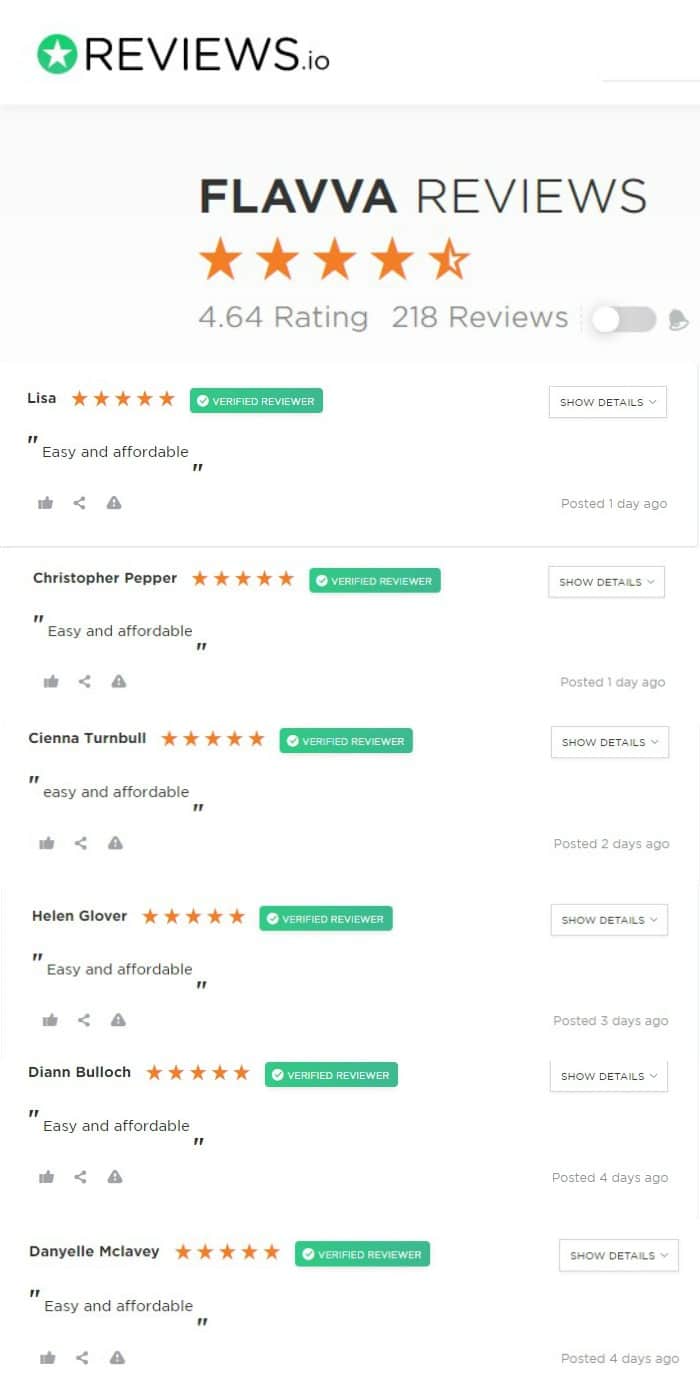

The credibility of a company can come down to having good reviews, and it’s reassuring to hear it’s gone well for others.

However, it’s been highlighted recently, particularly with larger retailers, where people have been paid to leave a review, or are incentivised with free products.

I’m not saying this company has, but some of their reviews look a bit familiar.

When you see a Flavva review that says “easy and affordable”…. but then you see the same thing multiple times, I start to question how much of a “verified buyer” they really are. (And these are only the ones on the first page).

Perhaps I’m over cynical…?

And, then you see a heartbreaking one-star review buried in with the others…

For those who cannot read text on images, Nikki Turner, another verified buyer, posted one week ago:

DO NOT WASTE YOUR MONEY, THEY TAKE YOUR FIRST WEEK AND DELVERY MONEY THEN STOP RESPONDING TO YOU . NO SHOPPING RECEIVED, THEY PREY ON PEOPLE WHO CANT OTHERWISE AFFORD TO SHOP. I NOW HAVE NO WAY TO FEED MY CHILDREN AS I WAS RELYING ON THIS. RIP OFF SCUMBAGS

There are other options

If you’re hungry and don’t have much cash, then a buy now pay later supermarket may sound like a huge relief.

But when you get into the details, it’s not as good as first seems.

Before you try using it, have you:

- Asked friends/family for a small loan for food or an invite to dinner – ok, you may not have anyone who you can ask.

- Visited a community “pay what you can” cafe – maybe you don’t have one near you?

- Got a referral to a food bank – perhaps you’ve already had three referrals this year and cannot get another one.

- Working? Ask your employer for a small advance, unless you’ve done this too often?

- Not working? Apply for a budgeting loan or a budgeting advance if you’re on UC, unless you’ve got one and have too much outstanding?

If you’ve done all this and have no other option, then even using a pay later supermarket won’t work as you need to pay money upfront before they deliver any food.

We’ve got a guide on what do do if you’ve got no money for food. This will likely be a far better option to look at.

If you’re not in as much need, do you really need to buy food on a layaway scheme?

Yes, there is no interest so you may think it works out cheaper than using a credit card or overdraft, but the extra cost of the items, plus the delivery fee, may mean you spend just as much.

What do you think?

Are they a rip-off? Or are they just trying out a new business idea?

Could it be handy for some?

Are other options out there better?

Whatever you do for your food shop, it can be hard enough keeping on top of forever changing prices.

When something comes along that looks fab, please take it with a pinch of salt, spend a bit of time looking into it and working out if it’s legit.

You can always come and ask in Reduce Your Supermarket Spend where there are thousands of savvy shopping sharing tips daily.

Enjoy this post? Why not also sign up to receive our newsletter.

We send out all the best money saving news and tips from the site and as an added

bonus you’ll get an exclusive £16 cashback from Quidco (new members only)

Saved a few quid with our tips?

If Skint Dad has helped you spend less or feel more in control of your money, you can support the site with a small contribution.

- I was sent a fake HMRC tax notice. Here’s how to spot the scam - 8 January 2026

- A once-a-year money check most families forget (with rough savings) - 6 January 2026

- The January bills reality check: the traffic light method that works - 1 January 2026