Energy prices are rising, and switching doesn’t always lower your bills. So, here are the best tips for saving energy.

£10 BONUS OFFER: Earn easy cash by watching videos, playing games, and entering surveys.

Get a £10 sign up bonus when you join today.

Join Swagbucks here >>

We all know that energy bills are going up, and it’s going to hurt, particularly when it’s colder over winter.

The obvious tip everyone used to say was to switch providers (which is still a good tip), but even that’s not working anymore! I’ve seen comparison sites not quoting and providers not taking on new customers!

The prices are sky-high for everyone, and energy providers are shutting down, but we still need to save.

So, we’ve pulled together the best tips for saving energy – without another mention of trying to switch.

Save money on energy bills

Around 13% of households – 3.18 million – in the UK are living in fuel poverty. That stat, from the government, was from 2019.

Unfortunately, with increased energy prices and a struggle to keep a good income, that number has risen further in 2021, 2022, and while we keep the 2023 £2,500 price cap, we still don’t know what happens when it is lifted.

So, here are practical tips to save on energy bills and use less gas and electricity, so you can stop questioning why is my energy bill so high.

What uses the most electricity?

Look to work out which appliances use the most electricity at home and turn them off when you don’t need them.

Even leaving appliances on standby uses up energy.

Do you need your microwave turned on at the switch so you can see the time? Probably not, so switch it off.

It may not seem like a lot, but when you look at what uses the most electricity in a home, you can see how much the costs add up, especially when things are constantly left on over the year.

Insulate your windows

You can buy cheap plastic insulating film to cover your windows.

It’s transparent, so it won’t make any difference to your view but acts as a secondary form of double glazing.

You will reduce your heat loss by up to 35% using insulating film.

Foil your radiators

You can waste less heat by adding heat reflective insulation at the back of your radiators.

Using energy savings panels will mean you don’t heat the wall, and it pushes the heat into the room where you need it.

They’re mega easy to install and can be cut to size.

If you’re specifically looking at tin foil, take a look at the disadvantages of foil behind radiators.

If you don’t have radiators, consider looking in the what is the cheapest electric heater to run.

Bleed your radiator

When you bleed your radiator, you release any air trapped inside it.

This then helps make sure your central heating system runs more effectively, and you’ll reduce your energy bill.

If your radiators are rattling or banging when your heating is on, you know it’s time to get your radiators bled.

It’s easy to do yourself with a radiator key for a couple of quid, a towel and a bowl (just in case).

And here’s how to bleed a radiator without a key if you don’t have one yet.

Look after your fridge freezer

Although you don’t want to turn off your fridge freezer to save money, you can make it run more efficiently by not overfilling it, allowing space for cool air to circulate.

Also, check seals are airtight and replace them if they need.

And, it’s worthwhile cleaning the back of the fridge with a vacuum from time to time to remove dust build-up on the condenser coils. This can improve efficiency (and lower your costs) by 30%.

Use your washing machine’s spin cycle

Instead of using your tumble dryer – which costs a lot on your electric bill a year – there are a few things you can do to speed up the drying of your clothes.

When your wash is finished, put the washing machine on a further spin cycle.

These extra 10 minutes will get more moisture out of your clothes so they can dry quicker. Even if you do go on and use your tumbler dryer, you won’t need to use it as long.

Use your tumble dryer wisely

Also, don’t just bung clothes straight inside the dryer; untangle them first so the airflow is more even.

Clean your tumble dryer filters

It’s well worth getting into the habit of checking your tumble dryer filter after every use.

This way, there won’t be any build-up of fluff, and your appliance can work to its full potential.

Don’t use your tumble dryer

Where possible, try to dry clothes outside when it’s hot or windy (which I know is easier said than done when it’s raining so often)! Or use these tips for drying clothes indoors much faster.

Cook differently

Your cooker and hob use a lot of energy when they’re running, so consider switching to alternative ways of cooking.

Use a slow cooker (which means you get to use cheaper cuts of meat, too) as it’s cheaper to run.

Instead of boiling veg on the stove, invest in an electric steamer; they’re not even that expensive.

Leave the cooker door open

Not while cooking; otherwise, you’re wasting the heat.

However, once you’ve finished cooking, leave the oven door open so the heat can make its way through the house.

Batch cook

If you have something cooking in the oven, get another thing cooking instead of letting the space get wasted.

Doing this will save having to turn the oven on again another day and save you time needing to cook from scratch in the future.

Use lids on your pans

If you are cooking on your hob, make sure to use a lid on your pans as the temperature warms up a lot quicker.

Boil water in your kettle first

Instead of heating cold water on the hob, boil it using your kettle.

A kettle uses less energy than an electric or gas hob, so you save money, plus it’s quicker.

Clean your hobs and oven

Keeping everything clean from grease and dirt build-up means your appliances can work more efficiently.

Use your kettle wisely

Only boil as much water in your kettle as you’ll need to use.

If you’re unsure, measure water in a cup and pour it in rather than filling it straight up from the tap.

WFH? Use a flask

If you’re working from home, you might find yourself dashing to the kettle umpteen times a day (just me?). Then, your energy bill will start to sneak up.

Instead, make a batch load of tea or coffee when your start your day and keep it in a flask or thermos.

You could still leave it in the kitchen, so you get to have a walk away from your desk and a break, but it just saves that money on boiling the kettle again and again.

Don’t overfill the dishwasher

Bung it all in, in hope that you can avoid washing up, isn’t the most brilliant move.

Overfilling the dishwasher means it likely won’t work correctly, so you’ll need to rewash stuff, which costs more.

Clean your extractor fan

Remove the cover from your extractor fan in your bathroom once a month and vacuum away any dust.

This makes sure it runs more efficiently, saving you money, and makes sure you don’t need a repair or replacement sooner.

Don’t bath

Avoid having a bath as they use a lot more water than a shower, and you use gas or electricity to heat the water.

You can get energy efficient shower heads (another tip) to save the amount of water you use.

Buy energy efficient

When it comes to replacing appliances, try to buy the highest level of energy-efficient machine you can afford.

From March 2021, the rating for new products goes from A to G, with A being the best overall.

You may see older ratings from the old scale with A+++ (which could work out as a B or C on the new scale).

Change bulbs to LEDs

It’s only a small change and one that won’t cost you a lot.

LED bulbs can reduce energy usage by around 80%, plus they last a long longer than other bulbs, so you won’t need to buy as many!

Charge with solar

Using the power of the sun, you can charge your phone with a solar power charger bank.

You’re not going to be saving massive amounts, but it will cut down on plugs being left on and will mean you’ve got a backup power supply when you’re out.

Get help paying fuel bills

There are discounts and payments that certain families and vulnerable households can apply for.

Take a look at:

- Warm Home Discount

- Winter Fuel Payment

- Cold Weather Payment

- if you can get support with free gas and electric vouchers

Submit meter readings regularly

To ensure you get an accurate bill, it’s worth submitting a meter reading once a month.

If you underpay, you’ll need to make money up later, which means even higher bills.

What you want to avoid is something like “in debit” appearing on your bill, which will cause you issues if you let it continue.

If you are already on a smart meter, your readings should get sent automatically, but it doesn’t hurt to cross-check to make sure it’s working as it should.

If you struggle to read your energy meters due to a vulnerability, you can get help from your energy provider for free via the Priority Services Register.

Get a smart meter

And, if you don’t already have a smart meter, it’s well worth requesting one from your energy supplier.

Now the meter doesn’t actually save you money – you’d be on the same tariff, but it does make you are a lot more conscious about your energy usage.

Because you can see a daily running total of how much you’re spending, you start to understand how living impacts your final bill.

This can kick-start you into making a change (like many of the tips we’ve mentioned).

And, it now appears that having a smart meter could open you up to earning money. You can get paid to reduce your energy use.

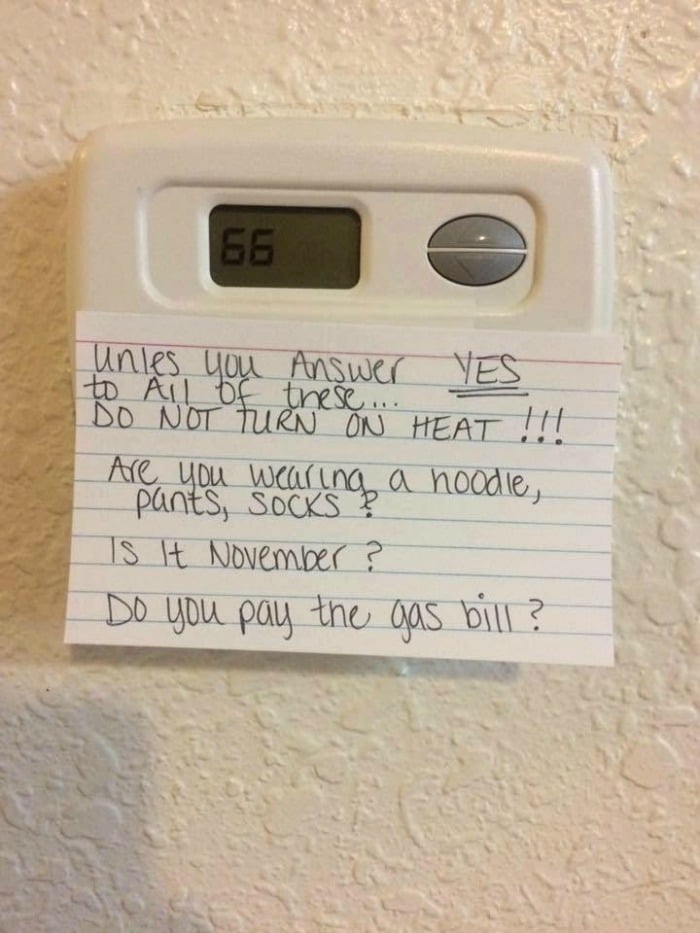

Turn your thermostat down

Turning the temperature down on your thermostat by just one degree can save you money.

And, you probably won’t even feel the difference.

You could likely save 13% of your energy use by doing this, according to Cambridge Architectural Research from 2012.

Pay by direct debit

Many energy providers give you a discount if you regularly pay by direct debit.

It’s not a huge amount, but the pounds add up.

Shut your curtains – sun down

As soon as the sun goes down, pull your curtains closed to block out the cold air.

Keep your curtains open – sun up

If you want your rooms to stay warmer in the day, keep your curtains open while the sun beams in.

(You could reverse this in the summer and keep them shut in the day to make it cooler).

Turn off the lights

It might be an oldie, but it’s a practical tip that works.

When you leave a room, turn off the light.

It doesn’t take extra energy to turn it back on – that’s an “old wives tale”.

Get a hot water bottle

Fill up a hot water bottle and put it under your duvet 30 minutes before you go to bed.

It’ll warm up the sheets making everything nice and toasty so that you can turn the thermostat off quicker in the evening.

Make a rice sock

As an alternative to a hot water bottle, you can make a cheap rice sock with stuff you’ve got in.

You need an old cotton sock (with no holes) and uncooked rice. You can even add a few drops of essential oils to the rice before you tie up the sock to make it smell nice.

Heat it in the microwave for one minute, and you will have a soothing effect on your muscles and keep you warm.

It still works fine if you put it under your duvet before bed to warm up the sheets.

Draft proof doors

Your front door may be a significant cause of heat loss.

Make sure to block up any drafts from the letterbox or keyholes.

If you’re privately renting and can’t do much yourself, you could try a Snail Saak to catch your post and stop drafts.

For any internal doors, use a draft stopper to prevent any random cool breezes. If you don’t want to buy one, you could try making one.

Draft proof everywhere else

Your doors are just one place you could be getting a draft.

Do you have a cat flap that could let in cold air? Are there any windows where you feel a breeze?

Where we had a hold drilled when satellite TV was used before, you could feel a chill right where the cable came in, so we filled it in.

These slight breezes make you feel colder than you are and will tempt you to turn on or increase the temperature on your thermostat.

Get a chimney balloon

Installing a chimney balloon can stop drafts coming down your chimney.

They’re straightforward to install yourself.

Line your curtains

Even if you have cheaper curtains, you can improve them without needing to buy heavy-duty ones.

To make your curtains better at keeping your room warmer, get some cheaper fleece material to line your curtains.

Use blankets

When watching TV in the evening, if you’re working from home, or you’re a bit chilly in bed, grab a blanket to get warm and cosy.

Heat the human, not the home is an idea whereby you keep warm individually without turning on your heating.

Use an electric blanket

Electric blankets are cheaper to run than central heating as they have a lower wattage.

While you still want to heat all your rooms to prevent dampness, it could mean you keep your thermostat on lower and keep warm with an electric blanket.

Socks and gloves

An extra pair of socks really does keep you warm.

I’ve worked from home for years now, and to keep our energy costs down in the winter, I wear fingerless gloves when working – it does help!

Get some slippers

While an extra pair of socks will help keep you feeling warm, slippers are the ultimate way to go.

They will keep your feet extra warm when it’s cold out.

Take a warm shower

If you’re cold, jump into a warm shower (not boiling) for a few minutes.

It will make you feel a lot warmer.

If the water is too hot, you’ll cool down too fast when you get out.

Don’t be too long in the shower or you might start to wonder why is my gas usage so high!

Dance like crazy

Whether you want to dance around your living room or take part in a free online exercise class on YouTube, doing a bit of a workout at home can make you feel warmer without having to turn up the thermostat.

Cover a bare floor

If you have a wooden or laminate floor, it can make the room warmer by covering it with a rug.

IKEA sell a wide range of medium and larger rugs from just £10.

Light some candles

Although a candle alone won’t heat a room, it can make you feel warmer.

Even a small amount of heat and light can warm you a little if you’re sitting nearby.

Have a sleep over

We plan to have a whole family sleepover in the same room when it’s been really cold.

It means we only need to heat one room in the house and can share the heat. It’s great fun and memories are made.

It’s not a great idea for the long term as rooms do need heating from time to time to prevent mould.

Go to the pub

Why stay in if it’s going to cost you more? You don’t have to drink expensive drinks if you go out, but could you sip a cup of tea or soda water?

Bonus points and extra warmth if you find a pub with an open fire.

Even if you cannot find a pub, maybe plan to spend a few hours with friends or family, so you don’t need to use energy at home.

Insulate your floorboards

You can add a thin layer of insulation under your floorboards in all rooms of your home.

This should help prevent any damp problems and prevents heat loss.

Insulate your loft

You might have warm air escaping from your loft.

Look into how much loft installation would cost, as it could reduce your energy bills.

Help with gas and electricity if you’re in debt

If you’ve struggled to keep up with your energy bills and have fallen into debt, there are energy grants available to help you get back to zero and have no energy debt.

There is one scheme open to anyone, no matter what energy provider you’re with, and there are a few specific to a few energy companies:

Open to anyone:

Grants for customers of:

- British Gas Winter Fund (new £2 million grant fund for winter 2021)

- Scottish Power Hardship Fund

- Ovo Debt and energy assistance

- E.ON Energy Fund

- EDF Energy Customer Support Fund

To be eligible for a grant, you’d need to show that you’ve sought debt advice, not have savings over a certain threshold and show you are in fuel poverty.

Check with each scheme, as their eligibility can be different.

After all that, just in case you want to switch energy providers, you can compare costs and get a quote here.

If you have any other ideas to keep warm for less over winter or generally use less energy all year round, please share them below.

- 25% off wine: supermarket wine offers and cheap deals - 25 April 2024

- Taylor Swift fans beware: fake ticket scam - 24 April 2024

- Massive (and disappointing) changes to the Asda Blue Light Card Discount - 23 April 2024

Jan Caldeira says

Put some clean bricks, large pebbles ect in the bottom of your oven when useing it, as these will store heat for longer when leaving oven door open after cooking.

2… Put a tent up in bedrooms and sleep in it, great fun for the kids, nice and cosy.

Peter Lewis says

This is a very comprehensive range of useful practical tips. Thank you very much.

Mr. Barry W Buttery. says

Thanks for a great list of energy saving tips. We shall be using them.

Barry W Buttery.

carol gillett says

When tubes of make and toothpaste ect seem empty cut tube open with scissors get another week or more for free.

DaveyB says

If you have an older Sky box you can make it shut down rather than going into standby, it takes a minute or so to start up but saves I reckon about £1.50 a week of electricity. Hold down the power off button on the remote for five seconds to make it shut down rather than go to standby.

Ricky Willis says

Thanks for the tip Davey!

simon firth says

open up your fireplace, get it checked out, and start an open fire with all the free wood that is around, pallets old trees etc

Thara says

Here are some more ways. Use a bowl of water once a day in order to stay clean and healthy. Instead of using the car do some exercise. Rather than turning on the heating consider wearing extra layers and hot food. Also buy some cheap hand and foot warmers online etc.

In the winter time don things like mittens, coats, hat and boots. Keep a active tab on energy costs. You can also make full use of your fireplaces in order to generate extra warmth and heat. Portable heaters are quite useful. So are heated drying racks, hot water bottles, electric blankets and the like. I use my own oven to create additional heat and like to rest by the fire.

Janice Johnson says

I already had some of your recommendations in place although not nearly enough!

Buying a slow cooker tomorrow when properly researched and priced well.

Will bleed radiators and buy energy saving back panels.

Am buying a fridge/freezer once properly measured, researched and priced well.

Goodbye to my old large freezer and fridge which also take up too much room in kitchen.